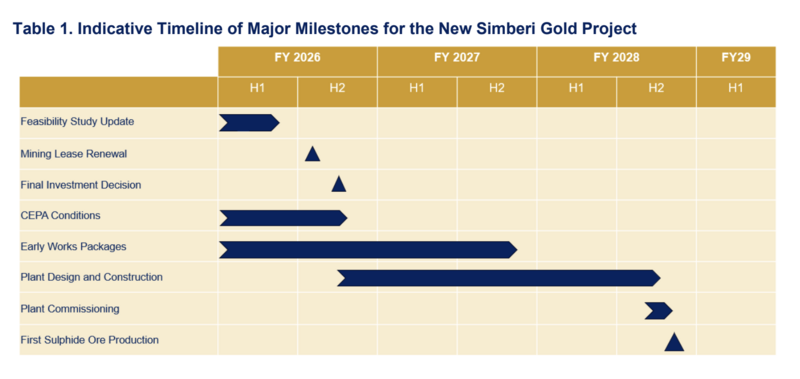

The Mining Lease for St Barbara’s New Simberi Gold Project has been formally extended until 2038, clearing a critical path for the company’s planned sell-down of the asset to China’s Lingbao Gold and Papua New Guinea’s government investment arm, Kumul Minerals. The extension sets the stage for a Final Investment Decision (FID) on the project, expected in the third quarter of fiscal year 2026.

The extended tenure aligns with the New Simberi Gold Project’s mine life, as determined by Proven and Probable Ore Reserves included in recent Feasibility Study results.

St Barbara received confirmation from Lingbao Gold Group Company Ltd and its subsidiary Lingbao Gold International Company Limited, as well as Kumul Minerals Holdings Ltd and its subsidiary Eda Minerals Ltd, that the terms and conditions attached to the lease extension satisfy the Mining Lease condition precedent for the transactions announced in December 2025.

Strategic Investment Milestone

St Barbara Managing Director and CEO Andrew Strelein described the extension as a pivotal step for the Lingbao strategic investment and Kumul’s 20 per cent asset acquisition. “This is the key step towards a Final Investment Decision planned for Q3 FY26 to expand gold production to more than 200,000 ounces per annum from the New Simberi Gold Project,” Mr Strelein said.

He expressed gratitude to Prime Minister James Marape, members of the Mining Advisory Committee, the Acting Managing Director of the Mineral Resources Authority (MRA) Harry Kore, former MRA Managing Director Jerry Garry, and their teams for supporting the lease application. He also thanked Kumul Minerals, the Simberi Landowners Association, the New Ireland Provincial Government, the Sentral Niu Ailan Local Level Government, the Namatanai District Development Authority, and the PNG Chamber of Resources and Energy for their assistance.

Lingbao Chairman Wang Pinran also welcomed the extension. “We are very glad to see the Mining Lease has been extended, especially during the settlement period of Lingbao’s strategic investment. It is a great milestone towards the development of the Simberi Project and importantly meets the key condition precedent,” Mr Wang said.

He further expressed thanks to PNG government agencies, Prime Minister Marape, community leaders and all involved parties, reaffirming Lingbao’s commitment to completing the investment settlement, developing the project with Kumul and St Barbara, ensuring good shareholder returns, and contributing to local communities.

Project Highlights and Financial Position

The New Simberi Gold Project, formerly the Simberi Expansion Project, is expected to be a long-life, low-cost asset with annual production exceeding 200,000 ounces at an All-In Sustaining Cost (AISC) of US$1,100–US$1,400 per ounce over a 13-year mine life based on Ore Reserves.

Early works growth capital for the project reached A$19 million in Q2 FY26, funding ball mill procurement, camp expansion, water treatment plant infrastructure, and mobile fleet expansion.

The company also continues development in Nova Scotia, with a 15-Mile Processing Hub pre-feasibility study outlining production of over 100,000 ounces per annum over an 11-year mine life at an AISC of US$708–US$1,432 per ounce and a post-tax payback period of less than one year. Meanwhile, the Touquoy Restart Study showed a low-capital, near-term production opportunity of 38,000 ounces over 13 months at an AISC of US$1,299–US$1,942 per ounce.

St Barbara has entered binding agreements with Lingbao and Kumul for strategic investment in the New Simberi Gold Project. Lingbao will acquire a 50 per cent interest in St Barbara Mining for A$370 million in cash, representing 40 per cent ownership of the New Simberi Gold Project. Kumul, through Eda Minerals Ltd, will acquire a 20 per cent interest, funded by a A$100 million loan from co-owners Lingbao and St Barbara to be repaid from project cash flows.

Both transactions are scheduled to complete at the end of Q3 FY26, coinciding with the FID.

The company strengthened its balance sheet through a A$58 million institutional placement to advance Simberi and Nova Scotia projects. As of 31 December 2025, St Barbara reported total cash, bullion and listed investments of A$187 million, including A$87 million of restricted cash, with no bank debt or hedging, excluding Lingbao’s A$32 million deposit.

Operational Performance

During Q2 FY26, Simberi produced 9,057 ounces of gold at an AISC of A$6,518 per ounce, contributing A$13 million in cash flow. Total recordable injury frequency rate increased from 0.2 to 0.5 over the quarter. Gold sales totalled 10,169 ounces at an average realised price of A$6,404 per ounce.

The Mining Lease extension secures the New Simberi Gold Project’s future and underpins the company’s growth strategy, marking a significant milestone in St Barbara’s development of PNG and international assets.