Pacific Lime and Cement Limited has entered a strategic national partnership with PowerChina PNG Limited (PowerChina) to advance the Orokolo Bay Industrial (Magnetite) Sands Project (OBP) in Papua New Guinea’s Gulf Province.

PowerChina has joined PLC’s wholly owned subsidiary, Mayur Iron PNG Limited, as the project’s development partner. The collaboration follows years of dialogue and a commercial reset designed to deliver the OBP at scale, with speed, and optimised value for PLC shareholders, the PNG Government, and local landowner communities. PowerChina replaces the project’s former partner, Pacific Unison, whose role under the Joint Cooperation Agreement was terminated.

The partnership brings a global engineering, procurement, and construction powerhouse to PNG. PowerChina’s parent entity is one of the world’s largest construction companies and was ranked 100th on the Fortune Global 500 list in 2025. Under the agreement, PowerChina will finance, construct, operate, and market the OBP’s products, targeting first cashflows in 2026. PLC retains 100% equity ownership and a majority of profits over the life of the asset, while continuing to focus on its flagship Central Lime and Cement Projects.

Strong foundation and accelerated delivery

PLC Managing Director Paul Mulder highlighted the scale and capability PowerChina brings to the project.

“We are excited to welcome PowerChina to our Orokolo Bay Industrial Sands Project as a development partner. PowerChina subsidiaries and project offices span over four continents and are involved in engineering, procurement, and construction (EPC); power; renewables (wind, solar); and large-scale infrastructure such as ports and industrial parks. PowerChina’s experience, reputation and financial strength makes it a trusted partner for national infrastructure and industrial growth initiatives," he said.

Mulder emphasised the strategic nature of the partnership, noting that under this Agreement, PowerChina, will provide development capital, with the Company and its parent (PLC) maintaining 100% equity ownership of the Orokolo Bay Project.

With profit share as the adopted remuneration mechanism, Mulder said that it aligns the parties to a clear delivery schedule that targets completion of construction and commencement of production in calendar year 2026. "This strategic and critical partnership provides the development capital, capability and certainty needed to transform Orokolo Bay into a near-term, fully operational, revenue-generating asset," he added.

The OBP has been in development for more than a decade, with over 2,000 drill holes and extensive field studies conducted to establish a Definitive Feasibility Study (DFS).

“The Orokolo Bay Project is underpinned by an extensive technical foundation of field programmes and detailed studies on the resource and project development, from concept through to Definitive Feasibility. The work completed by PLC over this 10-year period means PowerChina will enter the project immediately, continuing with construction while preparing for operations,” Mulder said.

Sustainable development and community benefits

PLC will remain the long-term developer and custodian of the OBP, maintaining engagement with PNG landowners and government agencies.

“Importantly, PLC as the long-term developer with PNG Landowners and PNG Government, remains the project owner and custodian of Orokolo Bay. Through magnetite production, shared value will be generated for the Company, PowerChina, and its PNG landowner stakeholders," Mulder said.

“This is a model that protects the Company and its parent (PLC’s) balance sheet, accelerates delivery, and positions the Project to generate meaningful employment, community development and shared value in partnership with the Government and people of PNG," he added.

The official said the progress of the OBP creates the opportunity for subsequent development of the valuable critical mineral resources, including titanium, vanadium, and zircon. "With PLC, PowerChina is an early mover in identifying the opportunity of these resources, which have the potential to support downstream processing opportunities, including critical mineral extraction through an iron and steelmaking process," he said.

The agreement ensures statutory payments, royalties, and landowner compensation are prioritised in the project’s cashflow structure, with joint oversight of accounts. The OBP is expected to generate significant local employment, skills transfer, and supply chain participation. Infrastructure upgrades and environmental safeguards will be implemented alongside community development programmes, providing tangible benefits to Gulf and Central Province communities.

Project scale and next steps

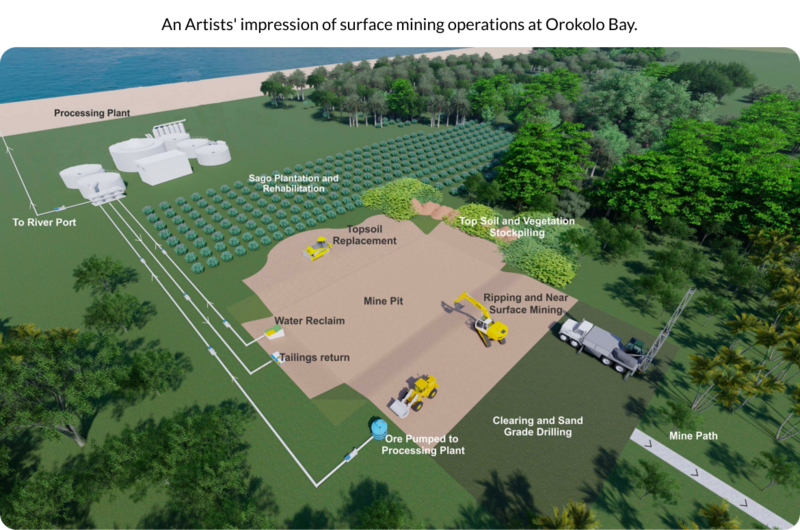

Initial production from the OBP will focus on high-grade magnetite, with potential downstream processing of critical minerals. PowerChina and PLC anticipate an initial production capacity of 300,000 tonnes per annum, with scope to increase to 500,000 tonnes under certain development scenarios outlined in the DFS. PowerChina will cover working capital, operating costs, and sales and marketing.

Following the termination of Pacific Unison’s role, PowerChina has begun mobilisation and staged construction, with commissioning and first shipments scheduled for the latter half of 2026. The partnership complements PLC’s Central Lime and Cement Projects, which remain its flagship development, and creates potential for co-development opportunities across PLC’s broader asset base.

PowerChina PNG Limited is a subsidiary of the Power Construction Corporation of China, a Fortune Global 500 state-owned enterprise founded in 2011. PowerChina specialises in large-scale infrastructure delivery, including hydropower, thermal power, renewable energy, waterworks, transportation, and industrial facilities, with subsidiaries such as Sinohydro, HydroChina, and SEPCO.

Pacific Lime and Cement Limited is advancing PNG’s lime, cement, and industrial sands sectors. Anchored by its Central Lime and Cement Projects, PLC is creating a fully integrated platform for local manufacturing and sustainable growth. Its diversified portfolio also includes renewable energy, nature-based forestry carbon credits, and a 16.6% stake in copper-gold explorer Adyton Resources Corporation. PLC is committed to environmentally and socially responsible project development, supporting decarbonisation and sustainable growth in PNG.