Background – Petroleum Industry in Papua New Guinea

The exploration for petroleum in Papua New Guinea has a long history which dates back to early 1900s. It began with a group of Australian geologists who first came in 1913 to PNG to investigate prospects of hydrocarbon on behalf of the Australian Government. Since then exploration activities went on without commercial discoveries until 1986 when Iagifu-Hedinia well was discovered. First commercial production commenced in 1992 with Kutubu coming on production followed by Gobe and Moran PNG reached a peak production of 150,000 barrels of oil per day in 1993 but since then it has been steadily declining as a result of natural depletion of the discovered oil resources.

While in search of oil large volumes of gas of commercial quantities have been discovered in the country. The gas reserves may be categorized based on three stages of maturity. Stage 1 gas include gas already in production, in particular, PNG LNG trains. State 2 of the gas include an estimated 15 tcf proposed for development. Papua LNG, P’nyang, Pasca and Stanley make up this component of gas. A further 7 tcf of mostly stranded gas fields retained under PRLs remain to be developed. This class of gas discoveries have no plan of development in the foreseeable future. In terms of proven, probable and possible (3P) gas reserves stand at 25.5 tcf while overall gas reserves potential is in order of 40 tcf. In relative terms PNG has more gas than oil.

Huge gas resources are the basis for building a gas industry in PNG and the Government has long-term perspective of building a gas industry in PNG. Having regard, a number of gas development proposals have been initiated and promoted by the developers for development.

PNG now hosts a world class LNG Project – the ExxonMobil led PNG LNG Project which commenced production in May 2014. The PNG LNG Project is the single largest investment that has ever occurred in the country. Not only that but it stands as the first gas project to be developed, and it serves as a catalyst for further gas development to take place in the country. PNG LNG has to date been the major source of revenue generation, infrastructure development, employment opportunities for many Papua New Guineans, training and skills transfer, community development, among others.

Among the proposals that have been looked at Papua LNG, P’nyang, Pasca, Stanley are among the proposed projects lined up for development. The country also has more than ten stranded gas fields under Petroleum Retention Licenses (PRLs). These discovered gas resources cannot be developed on standalone basis due to the nature of the volume content; insufficient for commercialisation and the gas fields are isolated meaning they sit away from any form of communication and infrastructure development. To develop them individually would be very costly and uneconomical.

Papua LNG Project

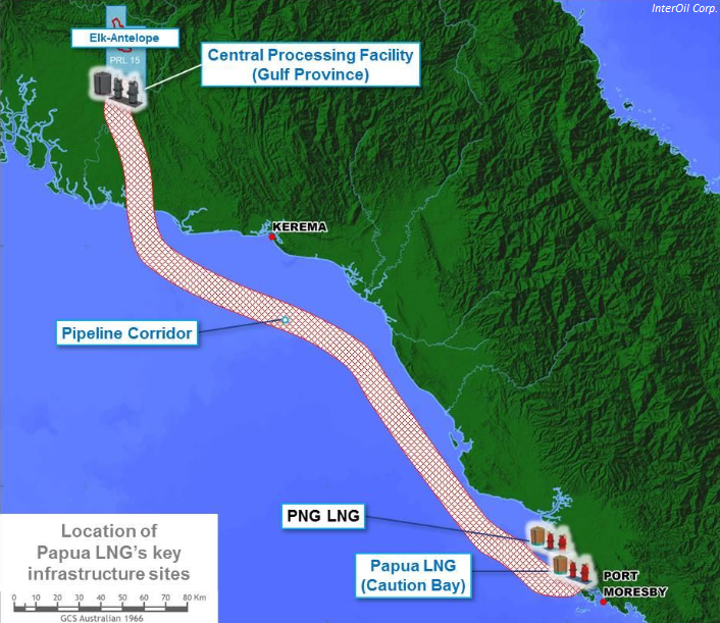

The Papua LNG Project has evolved from the prospecting stage, to the discovery of Elk/Antelope gas resources, to signing of the Papua LNG Gas Agreement and now to LNG development. The discovery of the Elk/Antelope gas resources which is located in the Gulf Province has given prominence to developing these gas resources in the country. The previous owner and operator InterOil proposed for a LNG project to be supported by the Elk/Antelope gas resources. Following the discovery of the gas resources several gas development schemes were announced by InterOil but none of the proposals advanced to development phase.

The country’s expectations for superior benefits from developing Papua LNG Project have been high. Why wouldn’t the country aspire to greater benefits from its premier resources – the gas resources? Such expectations have been on the back of “missed opportunities” from the first ever largest resource project – the PNG LNG Project that the country hosts. The general view among Papua New Guineans have been that any future gas resource development that followed the PNG LNG Project must generate superior benefits, higher and greater than those produced by the first LNG project. In order of the new gas projects proposed for development in the country Papua LNG has its nose in front of others. The recent signing of the Fiscal Stability Agreement re-affirms the parties’ commitment to progress the project to development stage.

Fiscal Stability Agreement

The companies expect the global economic environment to be right providing an economic environment conducive before they can commit to huge investments especially, investing in major resources projects. Economic conditions must be attractive enough for them to develop world class projects. The key factors such as oil price in which gas price is linked, gas markets and other conditions must be right as their movements can negatively or positively impact on return on investment. Unexpected global pandemics such as COVID 19 have devastative impacts on the petroleum industry. The petroleum industry is still trying to find its position from the impacts of the pandemic in 2020 and 2021.

At national level the role of the host Government is critical in the development of key resource projects such as Papua LNG Project. The companies’ desire is to see Governments providing fiscal, legislative, policy regimes and stability for investments to take place in the country. The Fiscal Stability Agreement signed on the 9th of January 2021 between the Independent State of PNG and the Papua LNG Project Participants re-affirm the Government’s commitment that it will not temper with the fiscal terms that were agreed between the parties in the Gas Agreement executed in April 2019. The Project Participants will make significant investments in developing the Elk/Antelope gas resources hence, they expect risk free environment. It is imperative on the part of the Government of PNG to ensure there are sufficient assurances and stability accorded to the companies during the development and operation phases of the Papua LNG Project.

In this respect, the assistance and co-operation of the project host government is critical for projects to be developed. The role of the Fiscal Stability Agreement is to provide sense of comfort and assurance on the part of the Government of PNG that it will commit to the terms agreed in the Gas Agreement and any future changes to the fiscal regime by the Government will not apply on the terms agreed for the Papua LNG Project. The Fiscal Stability Agreement is not a separate agreement from the Gas Agreement signed two years ago. It rather serves as an annexure to the Gas Agreement. The Fiscal Stability Agreement is part and parcel of the Gas Agreement. The Fiscal Stability Agreement is required to give confidence to the investors of the stability of the project. From the perspective of the Project Participants the Fiscal Stability Agreement should provide stability, sense of security and mitigate political and fiscal risks that may distort the delivery of the project.

The Elk/Antelope Gas Fields

The Elk/Antelope gas fields have their origins in one of the largest prospecting areas InterOil initially applied for in the late 1990s. The maximum number of blocks an applicant can apply for a prospecting license under the Oil and Gas Act 1998 is 200 blocks which equates to 16,000 square kilometres. A block is equivalent to nine kilometres by nine kilometres so 200 blocks would aggregate to 16,00km2. The original PPL that now hosts Petroleum Retention License (PRL 15) was top filled and PPL 238 issued to InterOil in March 2003 as a consequence of the Fiscal Incentives the Somare Government introduced at the time. The incentive package was introduced to encourage and reverse the dwindling exploration sector in the country. The incentives paid off resulting in reversing the fast declining exploration sector to one of active exploration sectors in the country.

InterOil’s primary focus in Papua New Guinea was to establish an oil refinery which it was successfully awarded the first Petroleum Processing Facility License (PPFL1) to develop and operate the Napa Napa Oil Refinery. While pursuing oil refinery project InterOil decided to enter upstream exploration sector. The areas InterOil applied for were “frontier” areas, not many companies were interested in. Many oil companies concentrated their efforts on the proven oil province; further west especially in the Southern Highlands, Hela and Western Provinces. Little did they know that this area was highly prospective with chance of major gas discoveries in the country. InterOil was convinced it would discover hydrocarbon and so it did after years of active exploration work.

The gas fields that underpin the Papua LNG Project sit in two gas fields namely Elk and Antelope. These gas fields were named after animals found especially in Canada since the original owners Phil Mulacek and Christian Vinson are Canadians. The Elk 1 well registered a gas discovery on 26th June 2006 in PPL 238 which later changed to PPL 476. On 01st May 2008, the Antelope 1 and Elk 4 wells registered gas discoveries in PPL 237/238 which later became PPLs 475 and 476 respectively. Subsequently, wells were drilled successfully in PPLs 237 and 238. These discoveries and further work that current Operator Total has undertaken since taking over the Elk/Antelope gas fields provide the foundation volume for the proposed Papua LNG Project.

In order to confirm the discovered gas InterOil engaged resource certification companies including GLJ and Knowledge Reservoir to provide assessment of the gas resources in the Elk/Antelope fields. In 2008 and 2009 GLJ concluded that the fields combined contained more than 8 tcf (trillion cubic feet) of gas and over 100 mmbbls of condensate contingent resources.

Upon receiving the reserve certification reports the Government of PNG needed second opinion so it engaged Gaffney Cline & Associates (GCA) to provide a 3rd party certification of the Elk/Antelope gas resources.

The GCA report produced total 2P recoverable sales gas resources in the Elk/Antelope fields of 6.5 tcf. However, GCA indicated that the above volumes did not take into account 5% CO2, fuel and flaring so the Department of Petroleum assessed that the saleable gas resources would be about 4.85 tcf when it took these qualifications into account. It was also recommended that further appraisal wells should be drilled to ascertain full extent of the reservoir and increase the level of confidence in the resource finds.

When Total took over operation of the project one of the key tasks was to work on improving the gas resources. The company undertook aggressive upstream work. The aggress efforts both the previous and the current operator have put into the upstream exploration including drilling and appraisal work programs further improved the discovered gas resources. The Gas Agreement clearly has more than the 8 tcf InterOil estimated at the time as the foundation gas underpinning the Papua LNG Project.

Petroleum Retention License (PRL 15) Award

The discovery of gas leading up to the declaration of location as per the requirements of the Oil and Gas Act 1998 enabled InterOil to successfully apply for a Petroleum Retention License over the blocks that contained the discovered gas resources. On 30th November 2010, InterOil was granted PRL 15 over the 9 blocks covering the Elk and Antelope gas fields. As required by the oil and gas law InterOil had submitted approved work program and expenditure proposals for implementation during the term of the PRL. InterOil, as the holder of PRL 15 committed to implementing work programs including additional wells, seismic and geoscience studies, social mapping, social mapping and marketing studies. The intent of a Petroleum Retention Licence is for the license holder to retain the discovered gas while further work is undertaken for commercialisation of the discovered resources.

In assessing an application for a PRL there must be an economics assessment justifying that the gas discovery is not commercial to develop thus it should be retained under a PRL requiring further commercialisation studies to be undertaken. It is to be noted that PRL 15 was granted having passed the commerciality test. The PRL provided the impetus to the license holder to retain the asset and further work continued.

Concepts for Developing of Elk/Antelope Gas Resources

The gas resources that InterOil discovered provide the resource base for development. InterOil since the discovery of the gas had started considering a number of development schemes to develop the Elk/Antelope gas. This led to the signing of the Project Agreement which was signed on 23rd December 2009 between the Independent State of Papua New Guinea and LNGL (Liquid Niugini Gas Limited). Under the agreement it was agreed that LNGL and InterOil would develop a 2 train 7.6 to 10.6 mtpa capacity LNG project.

The term of the Project Agreement was tied to the term of the Petroleum Development License (“PDL”), which is 25 years plus 20 years extension of the license. The Project Agreement, amongst other things, set out the fiscal terms to apply to the project. In summary, the key aspects of the project described in the Project Agreement constitute the following:

- To be a World Class Project (project size and scope of international scale and quality);

- To produce LNG using internationally recognised technology;

- To be operated by internationally recognised and reputable operator experienced in operating LNG liquefaction facilities and assets similar in size, scale and nature of the Project Assets

- To be located at, about or near the InterOil refinery, Napa Napa, Port Moresby or at such other location, provided that the State has approved such other location in writing; and

- To have a manufacturing capacity of between 7.6 million and 10.6 million tons of LNG per annum.

It was clear at the time that the intention was for this project to match the ExxonMobil-led PNG LNG Project in terms of scale, performance and quality and to be operated by a highly experienced, internationally reputable operator. On account of the similarity of the two LNG projects it was determined that the State would offer LNGL Project bag of fiscal terms similar to the ones offered to the PNG LNG Project.

However, for several years since the signing of the Gas Agreement InterOil did not secure a partner it was looking for. In fact, there were parties InterOil approached from mid-2009 with the objective of securing an operator but these efforts were not successful.

The delay was a cause for concern for the Government of Papua New Guinea. For example, the Minister for Petroleum and Energy and Secretary of the Department at the time sought clarification on the development of the project and the status on securing partner/operator of the project.

While search for a reputable partner to develop the project was going on announcements relating to the development of the project of different character in the Gulf Province were made. On 15th April 2010, InterOil announced that it would develop a condensate stripping project together with Mitsui & Co. Ltd of Japan using the Elk/Antelope gas. On the 28th of September 2010 it also announced that it would pursue small LNG projects with capacities of 2 to 3 mpta. Subsequently, InterOil announced smaller project concepts. InterOil further proposed a 50/50 gas development split with the State where it would acquire additional 27.5% interests on commercial terms, in addition to its legal right to a 22.5% participation interest in the project. As can be noted, the project had deviated from the original project concept outlined in the 2009 Gas Agreement largely owing to the fact that the project development concepts announced by InterOil were of small scale. None of the proposed development concepts were able to match the project concept described in the 2009 Gas Agreement.

InterOil and its partner LNGL had executed Heads of Agreement with Energy World Corporation Limited (“EWC”) and separately with FLEX LNG Limited and Samsung Heavy Industries for development of a floating LNG plant. The proposal comprised the following features:

- An initial land-based LNG plant of 2 mtpa comprising four trains of 0.5 mtpa;

- Additional trains of 2 mtpa to be added each year until a total capacity of 8 mtpa is achieved; A fixed floating LNG plant of 2 mtpa; and

- A condensate stripping plant.

However, none of these concepts were translated into gas projects. The same story remained throughout the period that InterOil had promoted the development of the Elk/Antelope gas resources since the signing of the Gas Agreement in 2009 until Total; the French oil giant appeared on the scene.

The Entry of Total SA as Operator of the Elk/Antelope (Papua LNG) Project

The efforts that InterOil had put in since the signing of the Gas Agreement finally paid off when a new partner Total was selected from among the oil majors known to many Papua New Guineans including ExxonMobil, Chevron, Shell, British Petroleum (BP) as well as other familiar names in PNG such as Oil Search, Talisman Energy, Horizon Oil and Santos. The new entrant Total was a new face in PNG. To be appointed a partner in the country’s Second LNG Project, especially to a company not familiar with PNG this French National Oil Company brought a new perspective to developing the country’s gas resources. Many of the people who followed InterOil’s final countdown of selecting a partner were most probably expecting some familiar names in PNG. Nevertheless, the key thing to note is that agreement between Total and InterOil followed an extensive international competitive bidding and evaluation process for development of InterOil’s interests in Papua New Guinea that InterOil had promoted since 2009. Under the agreement Total would lead the construction of the project and operate the proposed integrated LNG project. The parties further agreed that a final investment decision, reserves certification, basis of design and front-end engineering and design would follow.

Total in its own right is an undisputed oil major and LNG player but new to this part of the world as confirmed to Business Advantage PNG by Total’s Managing Director in PNG, Philippe Blanchard;

“When you are a French person like me, coming to work in PNG, it is like going to the other side of earth, working in an environment that has nothing in common with Europe. The Asia-Pacific region has a completely different mindset—challenges everywhere and, personally speaking, many things to discover. It’s a complete change to what I have been accustomed to in Europe or even Africa. It is really exciting”.

The company undoubtedly had set its plan to develop Elk/Antelope gas resources and so it successfully won the operatorship as well as acquisition of a major stake in the project. However, the transition was not as straight forward as it desired. Total had to overcome legal challenge from Oil Search Limited which claimed that the PNG based company had transacted a deal with InterOil and therefore had pre-emptive rights. The arbitration however found that this was not the case.

The commitment by Total to deliver the Papua LNG Project was demonstrated at the outset. A few months after its entry into PNG the Total’s Managing Director informed Business Advantage PNG this;

“We are experienced in LNG. We are present in the whole value-added chain of PNG projects from upstream assets, to building LNG trains and trading LNG products. We are the second actor after Shell in this business. We will take advantage of the experience and knowledge of all our partners to be able to deliver together a good project. So we want to put this arbitration period behind us and we want to fully restore the relationship with our co-venturers. We believe there is plenty to do to deliver the project and we need the energy of everybody”.

Mr. Philippe Blanchard further added that;

“We are committed to the project. We have already made a big investment before we entered the license. It is clear our interest is to deliver the project”.

It became apparent that the French oil major was destined to make an unprecedented impact on the country’s petroleum resources sector. The company was particularly focused on delivering the Papua LNG Project.

It was obvious from the outset of the takeover that the Elk/Antelope is a significant project in Total’s global portfolio and clearly this asset in Papua New Guinea provides an opportunity to grow and expand its business in the Asia-Pacific region. The acquisition of an interest in the Elk/Antelope project was a significant investment in large discovered resources which provides exciting opportunity for the French company to develop a new gas production and liquefaction hub in this part of the world. Clearly, the PNG asset added value to its long term player as a LNG player on the global stage.

Total’s acquisition of PNG asset did not stop at PRL 15. The company also had an option to take an interest in all of InterOil’s exploration leases in Papua New Guinea including PPLs 236, 237 and 238 which InterOil continued to operate at the time. The understanding between Total and InterOil was moreover to explore other business opportunities both in Papua New Guinea and elsewhere in the Asia Pacific region.

On project front Total quickly established a strong relationship with its joint venturers and strong support from the Papua New Guinea Government. This made Total settle in this part of the world where it hadn’t made much presence, and looked forward to developing the LNG project.

In the ensuing years that followed since its entry into the country’s oil and gas sector Total took over the operatorship of the Papua LNG Project. It also brokered formidable Joint Venture partnership with the existing players in PNG including ExxonMobil and Oil Search. Total has also worked with PNG’s National Oil Company – Kumul Petroleum in view of the State’s legal right to participate in the project. The State participation is formally exercised at the time of PDL award but it is important to establish some level of relationship with a key national partner Kumul Petroleum. The NOC, using its network and connection with the Government has played key role in progressing the Papua LNG Project to date. To successfully pull off major agreements such as the 2019 Gas Agreement and the Fiscal Stability Agreement Kumul Petroleum has played key role between the Project Participants and the Government in order for the parties to agree and execute such complex and important agreements.

The recently signed Fiscal Stability Agreement now paves way for a key milestone to be undertaken which is FEED (Front-End Engineering and Design Studies). FEED normally take up to 18 months but its completion will lead to developing Papua LNG Project. Further work included social mapping, landowner identification, environmental impact assessment, license and administration, among others. This will take the project to Project Sanction and reaching FID (Final Investment Decision).

Project Benefits

The recent execution of the Fiscal Stability Agreement signals that Papua New Guinea will host its second LNG project. This will be a world class LNG Project staged in the country and based on its magnitude the project is expected to generate multiple benefits, both direct and indirect. The direct benefits will be generated via the fiscal terms that have been negotiated in the Papua LNG Gas Agreement which was executed between the PNG State and the Total led Project Participants in April 2019. The Fiscal Stability Agreement signed in January 2021 between the parties confirms and provide the stability over the fiscal terms.

In Papua New Guinea the legislated fiscal regime for petroleum projects has been the basis for oil and gas investment in the country. The fiscal regime has also undergone numerous adjustments over the years. Nevertheless, the core elements remain to this point. The key features include production-based levies, the taxation of company profits and an additional profits tax that kicks in only when profits exceed a pre-determined level, particularly in the year in which the accumulated value of “net cash receipts” becomes positive and State participation. The new main features that have been introduced in the Papua LNG Gas Agreement include production levy and up to 5% DMO. The headline terms of the Standard regime are set out in the table below:

|

|

The main fiscal terms that make up the Standard terms comprises Corporate Tax, Royalty, Development Levy, Additional Profit Tax, Dividend Withholding Tax, Import Duty Tax, Export Duty and State Participation.

Despite the fact that Standard Fiscal Terms applicable to gas operations are legislated or defined in the Government policies each term is negotiated per project. The companies prefer exemptions and incentives awarded to them. The PNG LNG Project has an agreed set of fiscal terms which is applicable to the project. The Papua LNG Project will have the fiscal terms that were negotiated and agreed by the parties. Future gas projects will have specific fiscal terms negotiated and agreed between the State and the Project Participants.

Announcements made by the Government and the Project Participants following the signing of the Papua LNG Gas Agreement indicate that the parties have agreed on fiscal terms that may be best summarized as follows;

- Tax on integrated project basis, not segmented basis as the Papua LNG Project is envisaged to be development on the integrated basis

- The fiscal terms apply to all PRL 15 gas,

- Main fiscal terms including Corporate Tax, Royalty, Development Levy and APT to apply. But Import/Export taxes, Withholding taxes exempted as well as GST zero rated

- New fiscal devices introduced in the Papua LNG Project include Production Levy and DMO provision.

- State Participation at 22.5%

Direct project benefits to the State will be generated via the fiscal terms that have been agreed between the State and the Project Participants. However, as regards indirect benefits to the State there aren’t set formula based on which benefits from the project would be generated. Benefits such as schools, health facilities, roads, community projects, infrastructure projects and pin off business activities are counted as indirect benefits. The fact is that the indirect benefits do not have defined formula in which the benefits will be determined. Important Government policies in relation to indirect benefits are not defined. Recently, the Government has attempted to develop policies around Domestic Market Obligation (DMO), National Content Policy and Third Party Access but these policies are yet to be developed and approved by the Government. Given the obvious absence of fully defined policies it is impossible to quantify the indirect benefits to the State. This remains a grey area the Government must work harder.

One way the Government of PNG can benefit more from its resources development is to negotiate hard on the indirect benefits. This is where National Content policy becomes so critical; essentially this may ascertain how much of the benefits would benefit the country. It is to be noted that what is not known is the indirect benefits expected to be generated by the project. It is difficult and more challenging to predict indirect benefits especially, before the project has been developed.

Clearly defined Government policies in relation to the indirect benefits are needed to ensure the country benefits from its resource development. For example, the National Content Policy should define and state how much of the capital expenditure during construction should be spent in the country. There should be similar policy in relation to the ongoing operating expenses. The ad hoc handling of the indirect benefits to date has left the country missing on important benefits that emanates from resource project development.

Project Benefit Projections

On comparative basis the projected direct benefits from Papua LNG may be compared with two other petroleum projects in the country. These include Oil Projects and PNG LNG Project.

Oil production to end of 2019 from all PNG oil fields including Kutubu, Gobe and Moran was estimated at more than 531 million barrels (Mbbl) of oil. Assuming at an average oil price of $50 per barrel oil has generated an estimated US$20 billion plus on gross revenue basis. Kutubu attracted approximately US$1 billion in capital expenditure for development plus US$350 million in exploration cost. This was the major investment undertaken at the time to develop the major oil project in Papua New Guinea.

The PNG LNG Project cost US$19 billion in capital expenditure. PNG LNG had a foundation volume of 6.9 tcf. Assuming that LNG is sold at an average gas price of US$12/mmbtu this will generate around US$80 billion in gross revenues. However, the project has been subject of recent down turn in the global market due to global pandemic. It is now general knowledge that the gas price has been rock bottom in 2020. The operating cost and other factors do impact on the overall project revenues though this may be offset by increased production. PNG LNG Project connects several PDLs and covers approximately 700 kilometres of pipeline infrastructure from the upstream gas fields to the LNG plant site near Port Moresby. The project remains the country’s largest investment ever undertaken in the country. PNG LNG Project since coming on production in May 2014 has been the source of revenue generation, employment, infrastructure development, community development and host of other benefits to the country.

Relativity to PNG LNG the proposed Papua LNG is expected to cost less. Papua LNG project deviates from the first LNG project on many fronts. The ELK/Antelope gas will be extracted from a single PDL and the pipeline infrastructure will cover shorter distance from the upstream to the LNG processing plant site. Based on public information Papua LNG is anticipated to cost over US$12 billion and the foundation volume is estimated higher by about 3 tcf relativity to PNG LNG’s foundation volume. Assuming that gas price averages US$12/mmbtu the Papua LNG could generate over US$100 billion in gross revenue. Comparatively, Papua LNG will kick start as low cost and high volume project. Assuming that gas price averages above US$10/mmbtu Papua LNG is destined to be a high yielding project. However, Papua LNG Project is not immune to the unpredictable down turn in gas prices, high operating cost and other factors that may impact negatively on the revenue generation.

The indications are that revenue anticipated from Papua LNG will be higher. This means that more revenue is envisaged for the Government. Papua LNG is a key project in terms of revenue generation and so it must be supported by the Government. The Government’s undivided support for the project has already been demonstrated in delivering two pillar agreements: Papua LNG Gas Agreement and the Fiscal Stability Agreement. But that is not all. The Government will issue the licenses at an appropriate time. This will depend on Total delivering PDL requirements which include FEED, Landowner Identification and Social Mapping, Environmental Assessment, among others.

Among the oil producing countries PNG has been recognised as oil producer since 1992. In 2014, PNG entered the exclusive club of LNG producers in the world. The project serves as a catalyst for future gas development in the country. More gas development means more benefits to the country. However, the critical point to state here is this. As a country, how has PNG featured in managing huge benefits from oil projects and now PNG LNG? Have these benefits actually translated into improving the lives of the people, especially the rural population? Prior to Papua LNG commencing production in the next 5/6 years, P’nyang and others reach development stage the Government’s priorities and policies must be set differently from what has been the norm, ultimately targeted at improving the lives of the people and advancing the country forward.