At independence in 1975, Papua New Guinea (PNG) emerged as a young nation of 2.8 million people, transitioning peacefully from Australian administration with optimism grounded in the Charter of National Unity. Rich in natural resources like gold and copper, and supported by a vibrant agricultural sector, PNG’s early economic prospects were promising. The Panguna mine in Bougainville alone contributed significantly to exports and GDP, while the principle of “unity in diversity” helped shape a national identity across more than 800 language groups.

However, the country faced major hurdles, including limited infrastructure, low literacy rates, and political fragmentation, which complicated development and governance. Building a unified state amid such diversity was a formidable task, and economic vulnerability was evident in PNG’s heavy dependence on resource exports.

Fifty Years On: Progress and Persistent Challenges

Large-scale resource projects continue to drive revenues, while agriculture and small enterprise remain the backbone of rural livelihoods. Civil society is stronger, and democratic institutions have endured despite political turbulence.

Yet persistent challenges remain. Poverty, inequality, and weak institutions constrain development. Many rural communities remain disconnected from markets and services, while climate change threatens food security and coastal settlements. PNG stands at a strategic crossroad, with its future hinging on diversifying beyond extractives, strengthening governance, and investing in inclusive, long-term development.

Economic Outlook: Momentum into 2025

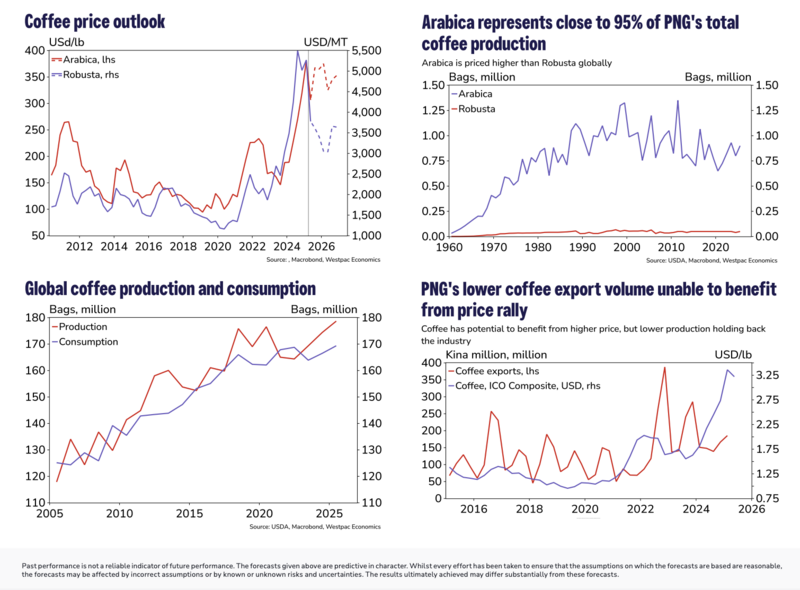

Mining activity has rebounded with Porgera mine restarting production, while LNG shipments remain steady. On the non-resource side, agriculture is showing signs of renewed dynamism, with coffee and cocoa exports benefitting from high global prices.

Westpac notes that this performance places PNG in line with China’s growth rate and ahead of many regional economies, underscoring its potential as a Pacific growth engine.

Bank of PNG and the Kina

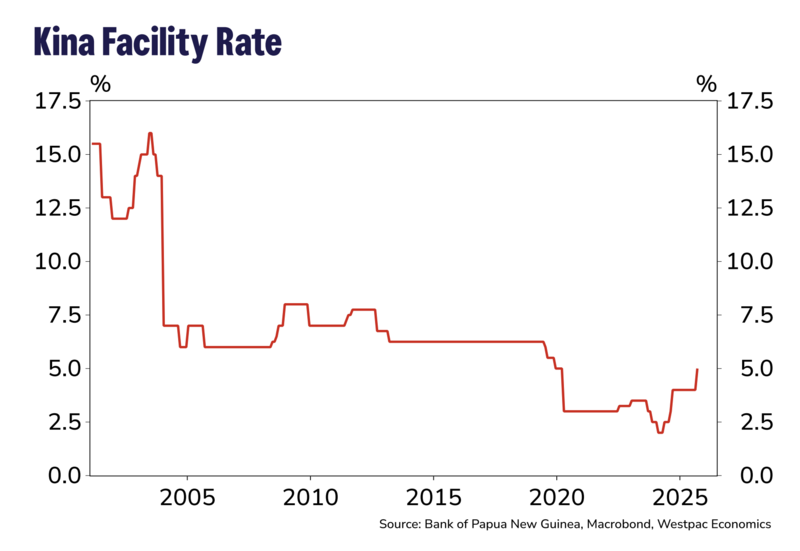

At its September meeting, the Bank of Papua New Guinea’s Monetary Policy Committee raised the Kina Facility Rate (KFR) from 4.0% to 5.0%, while simultaneously lowering the Cash Reserve Requirement (CRR) for commercial banks from 10% to 9%.

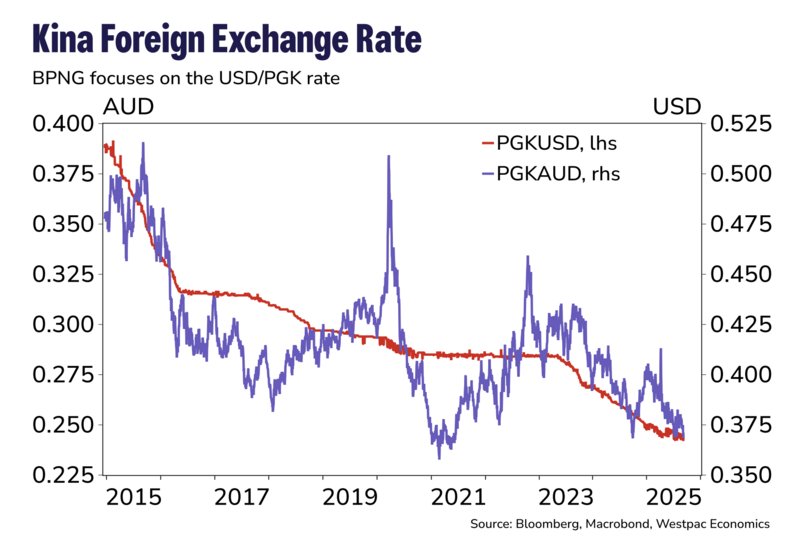

This mix of tightening and loosening reflects a balancing act: controlling inflation while injecting liquidity into the economy. The central bank also maintained its “crawl-like” exchange rate arrangement, which allows for gradual depreciation of the kina.

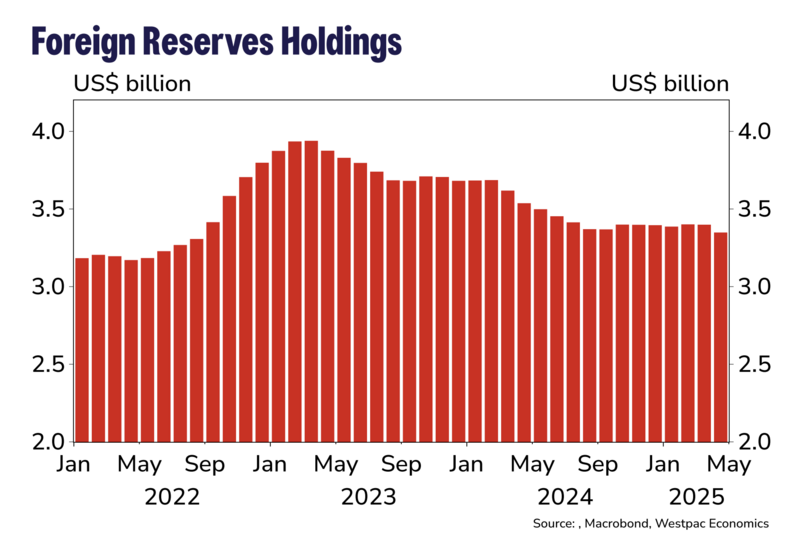

The kina has weakened around 4% against the U.S. dollar this year, improving export competitiveness but raising the cost of imports. Gross foreign reserves remain healthy at US$3.6 billion, covering nearly seven months of imports.

Westpac cautions, however, that the transmission of monetary policy remains weak. Higher policy rates have had limited impact on commercial lending and deposit rates, reflecting underdeveloped financial markets.

On the fiscal side, 2025 has been described as a “tough year” for government finances. Tax revenue collections fell significantly short of expectations in the first half of the year, compounding shortfalls in 2024.

This setback complicates the government’s 13-year Budget Repair Plan, which aims to gradually reduce deficits and place debt on a sustainable path. To stay within its official target deficit of K2.95 billion (2.2% of GDP), the government has signalled expenditure cuts of nearly 6%.

If spending restraint fails, Westpac estimates the deficit could balloon to K4.6 billion (3.5% of GDP). With debt levels already high, the report stresses the need for discipline and “policy adjustments” to maintain credibility with investors and development partners.

Inflation: Cooling but Uneven

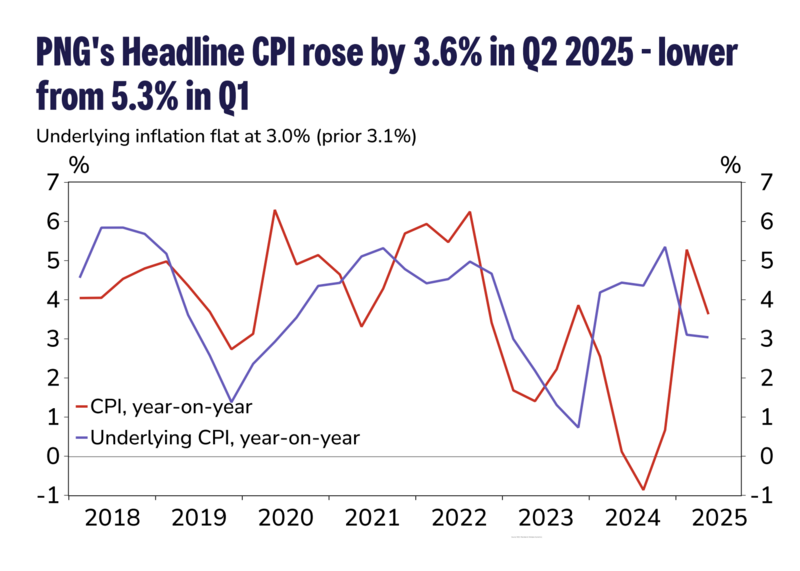

Inflation pressures have eased in 2025. Headline inflation slowed to 3.6% in the June quarter, down from 5.3% in March. Core inflation also edged lower to 3.0%.

The decline has been driven by stabilising food and fuel prices, along with a stronger supply of domestic agricultural produce. However, imported inflation remains a concern due to kina depreciation and global supply chain pressures.

Westpac expects inflation to moderate further, possibly reaching 3% by the end of 2025, although risks remain from commodity price volatility and fiscal slippage.

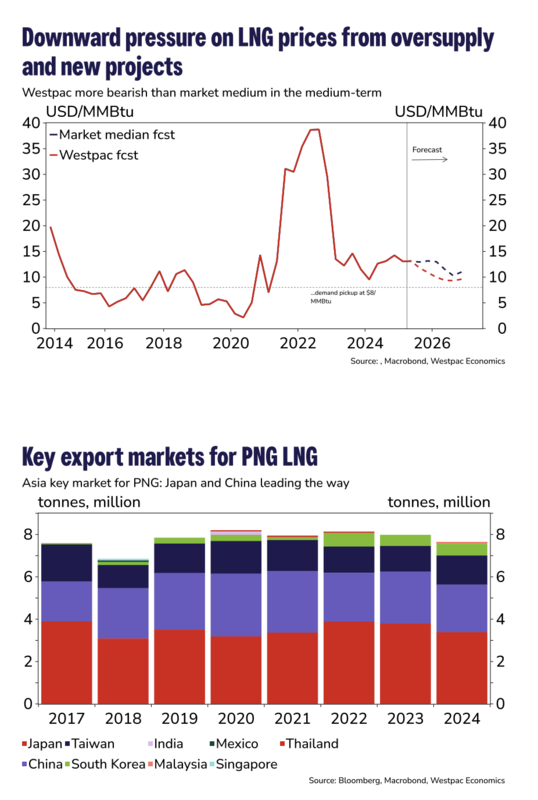

LNG: Anchor of the Future

PNG’s liquefied natural gas (LNG) sector continues to anchor its economy. Year-to-date to July, LNG exports to Japan rose by 9% to K5.5 billion, driven by strong second-quarter shipments.

The Papua LNG project, led by TotalEnergies, is seen as the next major catalyst for growth. While it has attracted less attention in recent months, news suggests a final investment decision (FID) is on track for the first quarter of 2026.

For PNG, this project promises not only economic growth but also thousands of jobs and greater integration into Asian energy markets. Westpac argues that its successful execution will “drive the next phase of prosperity.”

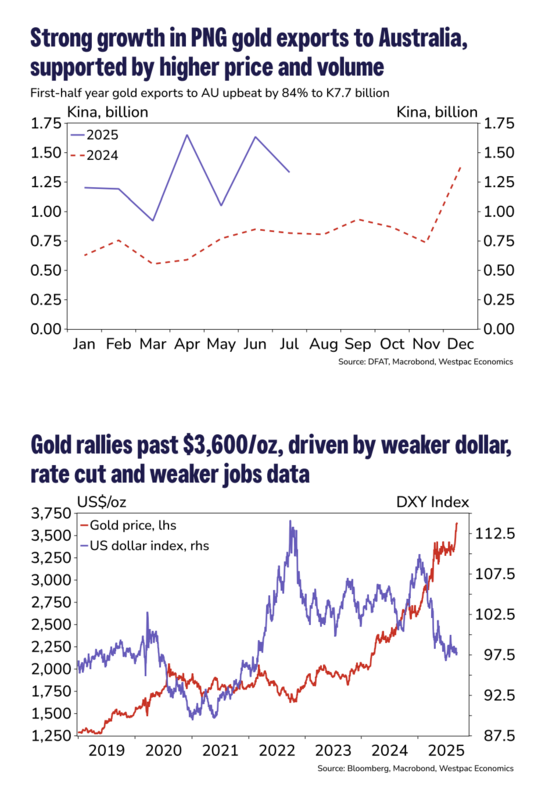

Gold: Benefitting from Global Uncertainty

Gold has emerged as a bright spot in PNG’s export basket. Prices surged above US$3,600 per ounce in mid-September, fuelled by a weaker U.S. dollar and concerns over global trade tensions.

This has boosted revenues for PNG’s gold miners and exporters, reinforcing the resource sector’s role in stabilising the economy. Together with LNG, gold earnings have helped offset weaker government revenues from other sources.

While resources dominate headlines, agriculture remains the backbone of livelihoods. Authorities and stakeholders have renewed their push to revitalise palm oil, rubber, cocoa, and coffee.

The sector has registered sustainable average growth of 2% in recent years, but Westpac stresses the need to scale up production and improve market access. A more dynamic agricultural base, it argues, would help reduce inequality and spread the benefits of growth beyond urban centres.

The Strategic Crossroad

Fifty years after independence, Papua New Guinea faces a familiar paradox: enormous natural wealth paired with structural vulnerabilities. Growth is robust, but fiscal slippage, weak institutions, and overreliance on extractives threaten stability.

Westpac’s update is cautiously optimistic, highlighting opportunities in LNG, gold, and agriculture while urging reforms in fiscal management, governance, and financial markets.

The report concludes with a call for long-term vision: “The message is clear — focus on reforms and investments that deliver the greatest long-term benefit for all Papua New Guineans, not just for now, but for future generations.”

As PNG charts its next 50 years, its challenge will be to turn resource-driven growth into inclusive development that uplifts every community — from highland coffee farmers to coastal fishing villages — while safeguarding the nation’s future.