Economic growth in the Pacific is expected to pick up next year, buoyed by strong resource output in Papua New Guinea (PNG), according to the Asian Development Outlook (ADO) September 2025, released on 6 October by the Asian Development Bank (ADB).

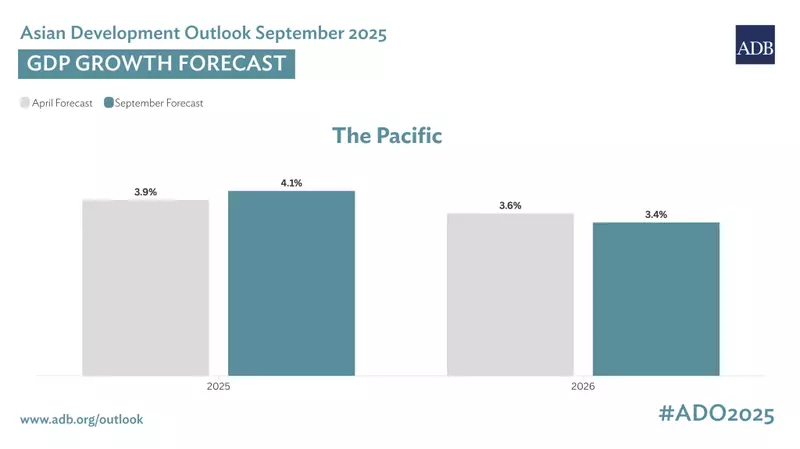

The report projects Pacific economies to expand by 4.1 percent in 2025, before moderating to 3.4 percent in 2026, an upward revision from the April forecast. The ADB attributed the improvement mainly to the mining and petroleum-driven performance of PNG, the region’s largest economy.

“While it is good news that growth will accelerate in the Pacific subregion this year and inflation forecasts are adjusted down, geopolitical and trade tensions still pose risks to growth,” said ADB Director General for the Pacific Emma Veve. “ADB remains committed to helping build resilience to potential shocks such as extreme climate events and disruptions to global supply chains.”

PNG’s economy is forecast to grow by 4.6 percent in 2025, before easing to 3.6 percent in 2026 as output from major resource projects stabilizes. Inflation projections remain unchanged. The report said that new investment decisions in mining, petroleum, and related sectors could provide an additional boost to growth.

In Fiji, the Pacific’s second-largest economy, growth is forecast to remain steady at 3.0 percent in 2025, but to slow in 2026 due to the indirect impact of United States tariffs on its key trading partners. Inflation is expected to ease over the next two years as fiscal measures and lower global commodity prices help reduce consumer costs.

ADB said Fiji continues to face “large shocks due to limited fiscal buffers and climate risk,” but ongoing reforms and new spending on water security and coastal protection should strengthen long-term resilience.

In Solomon Islands, growth is expected to hold steady at 2.9 percent in 2025 and 3.2 percent in 2026, with the inflation outlook revised upward for next year before easing slightly in 2026. The government’s recent shift to an expansionary monetary policy is expected to support growth while keeping inflation contained.

Vanuatu’s 2025 forecast was trimmed to 1.5 percent, reflecting delays in post-earthquake reconstruction, though growth is expected to recover to 2.5 percent in 2026.

In the Central Pacific, growth projections were adjusted slightly downward for Kiribati and Nauru, now at 3.9 percent and 2.3 percent in 2025, and 3.3 percent and 2.5 percent in 2026, respectively. Tuvalu’s growth outlook remains unchanged at 2.7 percent in 2025 and 2.5 percent in 2026. Public infrastructure spending is expected to remain a key growth driver across these economies, though commodity price volatility and supply chain disruptions continue to pose risks.

In the North Pacific, forecasts were mixed. Growth was upgraded for the Marshall Islands to 3.0 percent in 2025 and 3.5 percent in 2026, supported by fisheries and construction. However, projections were lowered for the Federated States of Micronesia (FSM) and Palau—now at 0.8 percent and 8.2 percent in 2025, and 1.1 percent and 3.9 percent in 2026, respectively. The ADB cited slow utilization of Compact of Free Association funds in FSM and a gradual tourism recovery in Palau.

Growth prospects across the South Pacific are expected to remain uneven. The Cook Islands is projected to post the highest growth in the region at 10.4 percent in 2025, before slowing to 2.5 percent in 2026 as post-pandemic tourism demand stabilizes. Growth in Samoa is expected at 4.0 percent in 2025 and 2.7 percent in 2026, while Niue is forecast at 3.4 percent and 3.0 percent. Tonga is projected to grow 2.5 percent next year, moderating slightly to 2.3 percent in 2026.

“Tourism and construction remain key growth drivers” in the South Pacific, the report said, though weaker agriculture and fisheries output could weigh on Samoa’s outlook. Inflation is expected to continue moderating but could face renewed upward pressure from global price movements.

Founded in 1966, ADB is owned by 69 members, 50 of which are from the Asia-Pacific region. The Manila-based multilateral lender said it remains committed to “helping build resilience to potential shocks” and supporting inclusive, sustainable growth through innovation, infrastructure, and partnerships.