A new global survey of mining executives has delivered a sobering outlook for Oceania, with several Pacific jurisdictions pegged at the lower end of global investment rankings despite their untapped mineral wealth.

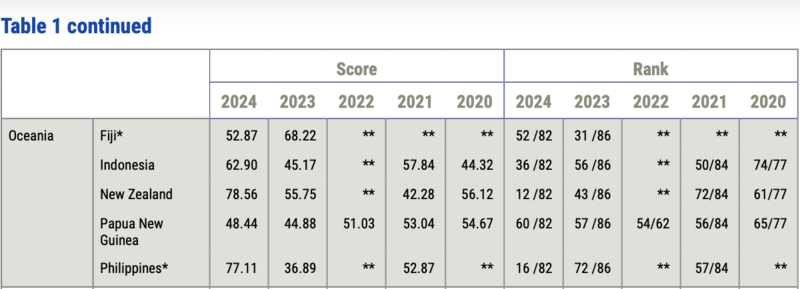

The Fraser Institute’s 2024 Annual Survey of Mining Companies, which assessed 82 jurisdictions based on geological potential and government policy, ranked Fiji, New Zealand, Papua New Guinea (PNG) and the Solomon Islands in the lower half of its Investment Attractiveness Index.

The survey was conducted between August and December 2024, drawing 350 responses from industry leaders whose companies reported a combined US$6 billion in exploration spending that year. The rankings reflect both the quality of a jurisdiction’s mineral endowment and the effectiveness of its regulatory and policy environment.

Fiji Emerges, Solomon Islands Lags

Fiji was the best-performing country in Oceania, ranking 31st, followed by New Zealand at 43rd. Papua New Guinea placed 57th while the Solomon Islands came in last at 84th, due to tied scores despite only 82 jurisdictions being listed.

The Solomon Islands again ranked among the least attractive places for exploration, weighed down by concerns over infrastructure, legal enforcement, and lack of skilled labour. It was also one of the lowest scorers in the policy index.

The country’s poor showing echoes similar results in 2023 and highlights the continuing challenge of attracting foreign capital despite abundant nickel and gold reserves.

PNG: A mixed picture

Despite being home to large-scale operations like Ok Tedi, Porgera and Lihir, PNG continues to struggle with inconsistent regulatory frameworks, land access issues, and concerns about political and social stability.

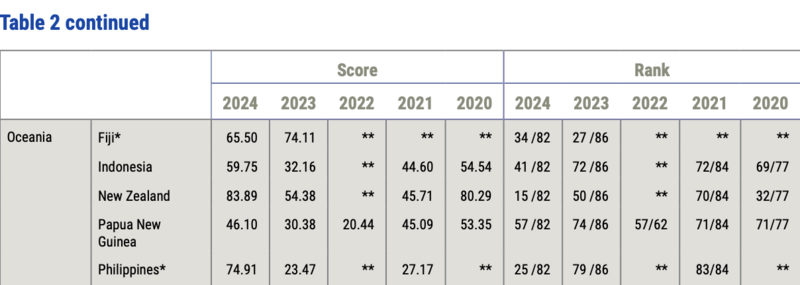

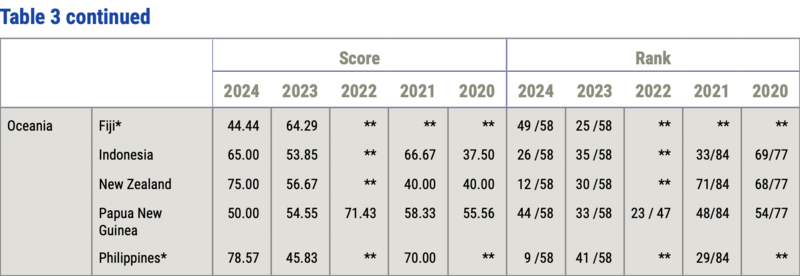

In the Policy Perception Index—a key component of the survey that rates jurisdictions on transparency, taxation, infrastructure and land rights—PNG ranked below many African and Latin American countries. Respondents cited regulatory uncertainty and permitting delays as major deterrents to investment.

The PPI, is a composite index that measures the overall policy attractiveness of the 82 jurisdictions in the survey. The index is composed of survey responses to policy factors that affect investment decisions.

The policy factors we examined include uncertainty concerning the administration of current regulations, environmental regulations, regulatory duplication, the legal system and taxation regime, uncertainty concerning protected areas and disputed land claims, infrastructure, socioeconomic and community development conditions, trade barriers, political stability, labor regulations, quality of the geological database, security, and labor and skills availability.

Still, the report acknowledged that PNG holds significant potential. With improved policy reforms, industry players believe the country could regain competitiveness.

The bigger picture

The Investment Attractiveness Index combines a jurisdiction’s geological appeal with its policy environment. According to the Fraser Institute, about 40 per cent of exploration investment decisions are influenced by public policy rather than geology alone.

This year’s global top three were Finland, Nevada and Alaska; while Ethiopia, Suriname and Niger occupied the bottom.

In contrast to Oceania’s mixed showing, North America and Europe dominated the top 10, driven by predictable regulatory systems, skilled workforces and favourable tax regimes.

A call for reform

While geologic and economic considerations are important factors in mineral exploration, a region’s policy climate is also an important investment consideration.

A significant share of mining professionals view policy factors across Oceana as especially challenging, reflecting concerns over regulatory uncertainties, infrastructure deficits, and governance—including land‑use and socioeconomic agreements—which collectively deter investment.

For Oceania, where many economies rely heavily on extractive industries, these rankings reinforce the need to address longstanding policy and governance gaps.