Photo Credit: Papua LNG - Map showing 260 km of offshore pipeline and 60 km of onshore pipeline extending from Elk and Antelope fields to Caution Bay

On March 07, 2023, in separate announcements, Santos, TotalEnergies, and Exxon announced the Papua LNG project had launched the first phase of a fully integrated front-end engineering and design (FEED) for the Papua LNG project in Papua New Guinea.

This follows a formal announcement by Prime Minister Hon James Marape a day earlier at the APEC House in Era Kone, PNG.2 Last December, PM Marape pressed mining and energy giants in the country to advance projects.

Papua LNG is one among the five gas and mining projects that are seen to expand the country’s economy to 200 billion kinas (US$55 billion) by 2029.

Papua LNG is expected to contribute 75 billion kinas to both the local and national economies over the next 20 to 25 years of production, according to Petroleum and Energy Minister Kerenga Kua. This is from an investment of US$10 billion (K35.2 billion) project.

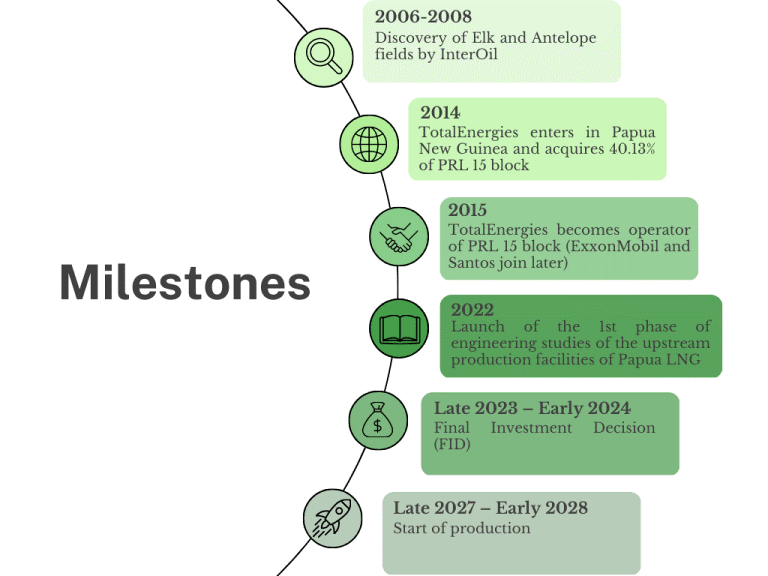

With so many billions of dollars at stake, the front-end engineering design is a significant milestone towards a Final Investment Decision (FID), its eventual construction, and finally into production.

The Project

Papua LNG is a liquefied natural gas (LNG) production project with a gas resource estimated at over 1 billion barrels of oil equivalent. The LNG export volume is expected at 5.6 million tonnes per year (Mt/y). The project comprises 9 production wells, one water injection well, 1 CO2 reinjection well and a gas processing plant. A 320 km pipeline will be laid out (out of which 60 km is onshore) from the processing plant to the liquefaction plant in Caution Bay, close to Port Moresby.

The FEED is expected to be followed by a Final Investment Decision (FID) later this year or early in 2024. If favorable, construction of the project will commence, and production is expected in late 2027 or early 2028.

Milestones in Papua LNG Project. It could take 20 years or more from discovery to production. Photo Credit: Papua LNG

Major Players

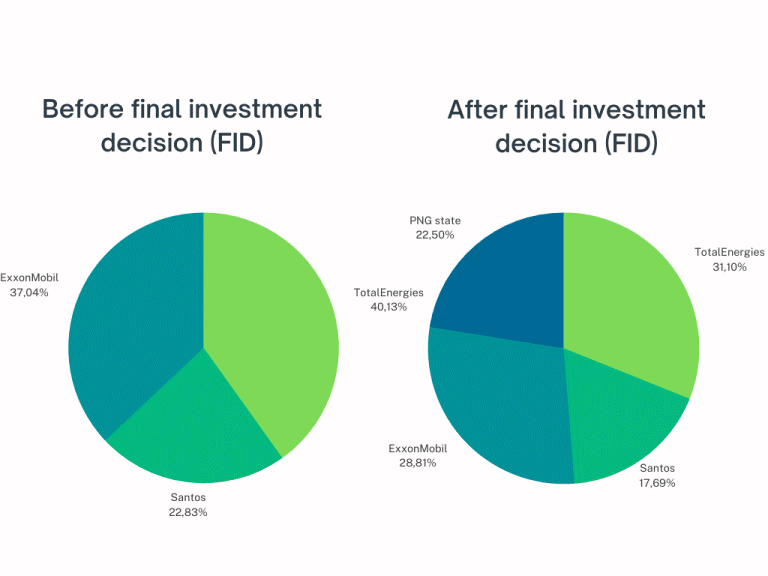

TotalEnergies (LON:TTE) holds 40.13% interest in Papua LNG and is the operator. TotalEnergies SE is a multi-energy French company, which produces and markets oil and biofuels, natural gas and green gas, renewables and electricity.

Santos (ASX: STO) holds 22.83% of interest in Papua LNG Project. Santos is an energy pioneer since 1954 and is one of Australia’s leading gas producers. The company commenced oil and gas exploration and production in Papua New Guinea in the late 1980s.

ExxonMobil (NYSE: XOM) affiliates holds 37.04% and has been in Papua New Guinea since the 1920s. As well as being responsible for the construction and operation of the US$19 billion PNG LNG project (33.2 percent interest).

ExxonMobil is the parent company of ExxonMobil PNG Limited, the operator of the PNG LNG project, who successfully and safely delivered PNG’s first LNG project in April 2014.

Kumul Petroleum Holdings Limited (formerly NPCP Holdings Limited) is a company incorporated under the laws of Papua New Guinea with all of its issued shares beneficially owned by the Independent State of Papua New Guinea through Kumul Consolidated Holdings (KCH) (formerly, Independent Public Business Corporation of PNG).

Kumul Petroleum may exercise a back-in right of up to 20.5 percent participating equity interest in the Papua LNG project, at the time of grant of the Project’s Petroleum Development Licence.

Mineral Resources Development Company Limited (MRDC) is a 100 percent State-owned company. It was incorporated in 1975 under the Companies Act to hold and manage State and Landowner equity interests in mining and petroleum development projects in PNG.

MRDC may exercise a back-in right of up to 2 percent interest in the Papua LNG project, at the time of grant of the Project’s Petroleum Development License.

Interest shares before and after final investment decision (FID) that comes after FEED is completed. Photo Credit: Papua LNG

PM James Marape has been pressing for PNG to receive a bigger share of the benefits from mining and energy projects since he first became prime minister in 2019, and so far, has succeeded in renegotiating deals with energy giants ExxonMobil Corp (XOM.N) and TotalEnergies on their gas projects. 3 In Papua LNG, PM James Marape says that the government has secured a 5% stake in the Papua LNG project for domestic market gas.

Front-end Engineering Design

Globally, liquefied natural gas (LNG) has drawn interest as a green energy source in comparison with other fossil fuels, mainly because of its ease of transport and low carbon dioxide emissions. However, LNG production is an energy- and cost-intensive process because of the huge power requirements for compression and refrigeration. Therefore, a major challenge in the LNG industry is to improve the energy efficiency of the LNG processes through economic and ecological strategies.

The FEED used 4 electric LNG trains with a cumulative capacity of 4 Mt/y, to be developed within the existing liquefaction plant in Caution Bay. It has secured up to 2 Mt/y additional capacity. The Project opted for 4 innovative electric liquefaction trains of 1Mt/y capacity each, a more modular solution that will reduce the Project’s carbon footprint when combined with renewable energy.

PNG Petroleum Minister Kerenga Kua said the Papua LNG venture will “build four small electric trains, four smaller ones, that’s to spread the risks, minimise costs and minimise risks of downtime.”

Another special feature is that a system for storing so-called “native” CO2, i.e. CO2 produced with natural gas, was designed to be operational on the first day of operation. The CO2 will be separated and reinjected into one of the two reservoirs to reduce the GHG emissions by circa 1 Mt/y.

Lessons from PNG LNG

According to PwC, Papua New Guinea has been exporting crude oil since the early 1990’s. Although production is modest and has relatively reduced overtime, it is one of the country’s major exports. In 2014, PNG launched the commercial operation of liquefied natural gas, boasting as the country’s top revenue-generating export product. The combined contribution of crude oil, LNG, and condensate will potentially comprise around 60% of the nation's export revenues in the near term.10 It is but fitting and proper that the PNG government maximizes returns from these investments.

PNG is not a new LNG country, says PM James Marape. He added that the country has gained experiences from PNG LNG on how to deal with landowners, and local and provincial governments. PNG LNG took 16 months from FEED to FID thus setting a benchmark for other LNG projects.

On the issue of local employment, Carmen Voigt-Graf and Francis Odhuno cited that while national employment figures in the formal economy grew substantially during LNG construction, many jobs were held by foreign workers. The major LNG developers have been criticized for not providing more training opportunities for local workers and instead heavily relying on foreign workers.

Many PNG government departments were taken by surprise by the project, and training institutions were not ready to provide training in relevant areas. They further illustrated the case of welders where according to the PNG Department of Labor and Industrial Relations (DLIR) had 600 licensed welders, but more than 5,000 were needed when construction began, so large number of specialist welders were imported, mostly from the Philippines.

Local employment is a direct impact benefit that citizens gain from any project. The issue of appropriate skills and training for such projects should not be taken lightly even to the extent that the company itself needs to train locals. While in cases where foreigners are required, they should work with an apprentice to ensure that they train someone behind to take over since PNG’s liquified natural gas industry is here to stay for the long term.

Investment share and employment along with other hard-earned lessons in PNG LNG will for sure be under the watch of Papua New Guineans to ensure these lapses will not be repeated then they and the government can truly say “we are better now.”

References:

- TotalEnergies. (2023, March 07). Papua New Guinea: TotalEnergies launches integrated engineering studies for the Papua LNG project [Press Release] https://totalenergies.com/media/news/press-releases/papua-new-guinea-totalenergies-launches-integrated-engineering-studies

- Marape, J. (2023, March 06). Statement By Prime Minister Hon. James Marape on the Occasion of the Formal Announcement of the Papua Liquefied Natural Gas (Lng) Front End Engineering Design Phase, PM James Marape News Page. https://pmjamesmarape.com/pm-marape-announces-papua-lng-project-feed-design-phase/

- Needham, K. (2022, December 05). Papua New Guinea PM Marape presses mining, energy giants to advance projects.Reuters. https://www.reuters.com/world/asia-pacific/papua-new-guinea-pm-marape-urges-miners-go-ahead-with-projects-2022-12-05/

- Esila, P. (2023, March 13). Papua LNG set to bring in K75bil. The National. https://www.thenational.com.pg/papua-lng-set-to-bring-in-k75bil/

- Papua LNG. (2023). Project. https://papualng.com.pg/papua-lng/project/?amp=1

- Papua LNG. (2023). Partners.https://papualng.com.pg/papua-lng/partners/?amp=1

- Luma, D. (2023 March 08). Five Percent Space for Papua LNG Domestic Market. Papua New Guinea Post Courier. https://postcourier.com.pg/five-per-cent-space-for-papua-lng-domestic-market0/

- Qyyum, M. A., Qadeer, K., & Lee, M. (2017). Comprehensive review of the design optimization of natural gas liquefaction processes: current status and perspectives. Industrial & Engineering Chemistry Research, 57(17), 5819-5844. https://pubs.acs.org/doi/abs/10.1021/acs.iecr.7b03630

- Energy Voice. (2022, December 12). TotalEnergies’ Papua LNG to use electric liquefaction trains in net zero push. Total Energies. https://www.energyvoice.com/uncategorized/468886/totalenergies-papua-lng-to-use-electric-liquefaction-trains-in-net-zero-push/

- PwC.Oil & Gas. https://www.pwc.com/pg/en/industries/industries-oil-and-gas.html

- Voigt-Graf, Carmen and Odhuno, Francis Odongo, Assessing the Labour Market Impact of the PNG LNG Project and Implications for Future Projects (March 26, 2019). Development Policy Centre Discussion Paper No. 78, Available at SSRN: https://ssrn.com/abstract=3360134 or http://dx.doi.org/10.2139/ssrn.3360134