Freeport Resources Inc. was recently granted an extension to its Exploration License for Nong River at the heart of its Star Mountains mine, while it still awaits ministerial endorsement for its license for its newly acquired Yandera copper mine.

“The company is pleased to announce that its application to extend Exploration License Number EL 1312 has been granted by the Papua New Guinea, Minister of Mining with effect from September 20, 2020 for a term of two years,” Freeport said in a statement on August 23.

"We at Freeport cannot overstate the importance of this renewal to the Company," said Gord Friesen, Chief Executive Officer in the same statement. "It reinforces our belief that Papua New Guinea remains a premier mining destination globally, while providing us with the visibility to conduct our proposed work programs in the coming months.”

Nong River, Friesen said, “is the most important license in the Star Mountains portfolio and will continue to be the main focus for future work at Star Mountains.”

Meanwhile, Freeport also announced that its applications to extend EL 2467 Mt. Abemh, EL 2001 Benstead and EL 1781 Mt. Scorpion have been granted by the Minister of Mining with effect from December 2nd, 2020, December 20th, 2020, and March 12th, 2020, respectively for a term of two years.

“The PNG Mining Cadastre Portal indicates that the renewal for EL 1335 Yandera is awaiting Ministerial Endorsement,” the company added.

EL 1312 is the key tenement within the Star Mountains Property, which consists of over 500 square kilometres spread across four contiguous Exploration Licenses (ELs) approximately 25 kilometres north of the Ok Tedi mine in western Papua New Guinea.

Since being discovered by Kennecott in the early 1960s, exploration work has been carried out by a range of companies, including Highland Pacific Limited and Anglo American Plc, with approximately 80% of historical expenditures being spent on the EL 1312 tenement.

The highest priority target, Olgal, has seen approximately half of the historic drill testing thus far. Virtually all the other priority targets, including the Futik, Fune, Kum Kom, Unfin, Bumtin, Tuk and Rattatat, amongst others, all lie within the boundaries of EL 1312.

About the Olgal Prospect

In 2018, H&S Consultants Pty. Ltd. completed a maiden mineral resource estimate for the Olgal deposit within the tenements.

Using a 0.3-per-cent-copper-cut-off grade, the deposit is estimated to contain 210 million tonnes of inferred resource grading 0.4 per cent copper and 0.4 gram per tonne gold, for 2.9 million ounces of contained gold and 1.85 billion pounds of contained copper.

Based on current market prices, this is equivalent to approximately 7 million ounces of gold equivalent or 3 billion pounds of copper equivalent.

Yandara purchase completed

On 16 August, Freeport announced that it has acquired all of the outstanding share capital of Carpo Resources Inc.

Carpo is a privately-held company which controls Era Resources Inc., a corporation established under the laws of Cayman Islands and which itself controls an exploration license located in Papua New Guinea commonly known as the Yandera Copper Project.

Freeport said Carpo was acquired pursuant to a share purchase agreement, dated effective June 25th, 2021, entered into with Carpo, and all of the shareholders of Carpo. The Company is at arms-length from each of Carpo, and the Vendors.

In consideration for all of the outstanding share capital of Carpo, Freeport has issued 20 million common shares to the vendors. In connection with completion of the transaction, Freeport does not expect to assume any material liabilities, nor does it expect to devote the majority of its working capital or resources to the development of Carpo or the Yandera Copper Project.

As a result, the transaction does not constitute a fundamental acquisition for the Company, within the policies of the TSX Venture Exchange. The transaction did not result in the creation of a new insider, or a change of control, of Freeport, within the meaning of applicable securities laws.

The acquisition of Yandera, which is one of the largest undeveloped copper deposits in the world, is in line with Freeport’s mandate to seek out, identify and acquire undervalued projects globally, the company said, after previously acquiring the Star Mountains Copper and Gold Project, also in Papua New Guinea.

The Yandera Copper Project

The Yandera Project area was the subject of intensive, drill-based exploration programs during the late 1960s and 1970s by a number of companies.

The historic activity, which included 102 diamond drill holes totaling over 33,000 metres, culminated in the preparation of a mining study by BHP, identifying the Yandera porphyry system as containing one of the largest undeveloped porphyry copper systems (with ancillary molybdenum and gold) in the world.

Subsequent to that, Era Resources Inc. spent over USD $100 million and drilled another 471 holes totaling over 144,000 metres. There remains opportunity for further exploration to increase the resource.

A Pre-Feasibility Study, completed by Worley Parsons in 2017 showed total resources of 959 million tonnes of copper equivalent grading 0.37% including measured & indicated resources of 728 million tonnes grading 0.39% copper equivalent, and 541 million tonnes of Probable Reserves averaging 0.39% copper equivalent.

The measured and indicated resources equate to 6.2 billion pounds of copper equivalent and total resources equate to almost 8 billion pounds of copper equivalent.

Location, Physiography and Accessibility

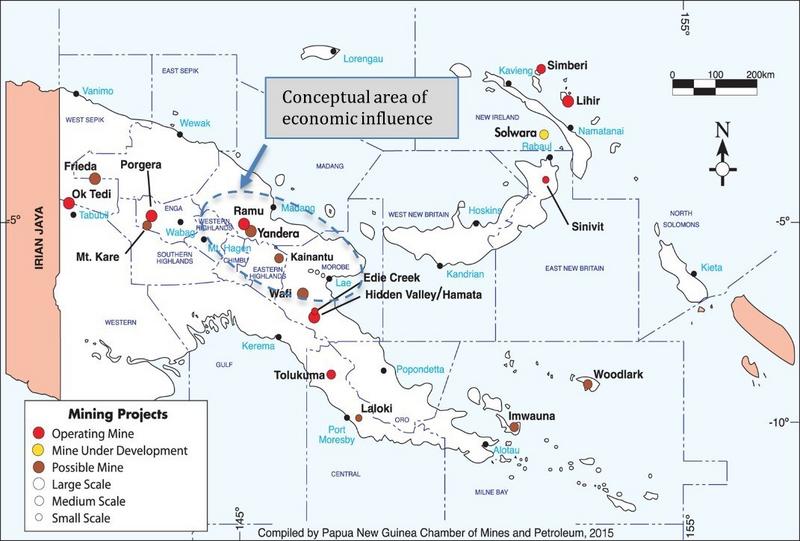

The Yandera project is located approximately 95 km southwest of the city of Madang in the foothills of the Bismarck Mountain Range, which is part of the central cordillera of New Guinea, at an elevation of approximately 1,900m above sea level.

The site is situated on the northern side of the range, about 13km east-northeast from Mt. Wilhelm, with the extensive floodplain of the Ramu River approximately 20km to the east.

The deposit area is mountainous with the Imbrum River valley to the west and the Tai-Yor River valley to the east. Materials and transport for the site team are via helicopter from Madang Airport or from a lay down yard which runs through the village of Usino, a 10-12 minute flight away.

Yandera History

In 1965, Kennecott acquired the Exploration License (EL) to work on the Project. They continued ownership and operated until 1973, when Triako Mines acquired the Project and had its operator, Amdex, complete the work programs.

Amdex jointly worked with Broken Hill Proprietary Company (BHP) on the property from 1974 to 1977. In 1978 Amdex joint-ventured with Buka Minerals.

Work and ownership between Amdex and Buka Minerals continued until 1984, when they dropped the Project. The Project sat idle until 1999, when Highland Pacific and Cyprus Amax acquired an EL and worked on the Project before dropping it prior to 2000.

The Project then sat idle again until Belvedere Limited acquired the EL for the property. In 2005, Belvedere formed a joint-venture with Marengo Mining Limited, who operated the property.

In 2006, Marengo Mining acquired the Project through the purchase of Belvedere's interest.

Since then, Marengo Mining, now Era Resources Inc., has been the sole owner and operator of the Project. Era was subsequently acquired by Carpo, which is now owned by the Company.

Geology

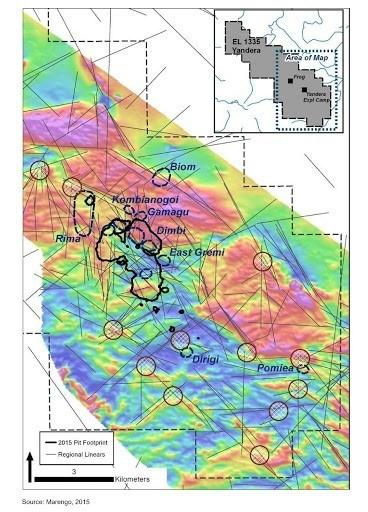

Yandera is an igneous, intrusive-hosted, structurally controlled copper porphyry system with ancillary molybdenum and gold composed of a series of adjacent, vertically oriented deposits along recognized structural trends.

Mineralization is concentrated in several deposits, namely, Imbruminda, Gremi, Omora, Gamagu and Dimbi.

Imbruminda, Gremi, and Omora are contiguous and separated from Dimbi by a low-grade, central, silica-rich zone, which is bounded on three sides by high angle faults.

The bulk of the mineralization is adjacent to these major structures on a northwest-southeast trend. Locally, north-northeast-trending cross faults bound mineral domains and reflect the structural complexity of the district.

The property lies within the New Guinea Orogenic Belt, which stretches from the southeastern portion of the island through the central mountain ranges into Indonesia, and to the west of Grasberg, Freeport McMoran's giant Copper-Gold mine.

The belt is home to some of the world's largest producing mines and deposits, including the aforementioned Grasberg, which hosts the largest reserve of gold and second largest reserve of copper in the world.

This belt includes slices of metamorphic basement and contains a variety of sedimentary packages. Above Paleozoic and early Mesozoic schists, marbles and granodiorite lie packages of Triassic to Jurassic volcanic, and clastic sediments, and Jurassic to Cretaceous clastic, volcanic, and volcanogenic sediments.

Freeport noted that mining in PNG “requires balancing the interests of mining companies with the local and national governments, the local communities and landowners all the while observing the environmental responsibility and sustainability issues.”

Despite these challenges, there are comparatively few areas left in the world that offer the potential for the development of large-scale mining projects within a district as prospective as the New Guinea Orogenic Belt, the firm noted.

Home to the giant existing mines Grasberg, Ok Tedi, Porgera and Lihir, PNG also has district-scale projects in the pipeline such as Wafi-Golpu and Frieda River.

Locals unsatisfied

Despite Freeport’s corporate updates on its holdings and Yandera in particular, local stakeholders are not encouraged by the company’s lack of communication on how it plans to develop the mine and the area around it.

Les Emery, who was President and CEO of Marengo Mining Inc. until April 2014 and was involved with Yandera for several years, says Freeport “has no detail on their near-term plans for the project, just a very general timeline.”

“Still, they are silent on the status of Exploration Licence 1335, why is this, what is the problem?” added Emery, who is not involved with Freeport but has voiced concerns on behalf of the community and local landowners around the mine.

In an exclusive interview with PNG Business News last issue, Emery said: “Failing to undertake these discussions (with local stakeholders) on a very regular basis will work against any group wishing to explore and ultimately bring a project to mine status.”

“I take pride in the fact that during my time at Yandera we put a big effort in maintaining a very strong relationship with the community at all times, this paying off with total support in return,” he added.

Others, responding on Freeport’s official Facebook page, were more direct.

Commenting on the company’s latest announcement on Yandera, anthropologist Dr. Laura Tamakoshi said: “While the report is meticulous when talking geology and the technicalities of running and trying to sell the project to investors, it is woefully lacking in discussions and inclusion of the concerns and needs of local landowners.”

Tamakoshi cited in particular the lack of dealings with the local Gende tribe, which she said she had carried out and written over 40 years. “Even the few of my numerous and lengthy census and social impact reports have been trivialized and sloppily misreported,” she said in her FB post.

“The impacts of mining projects even without any mining actually happening have been enormous in many ways socially, economically, politically, and culturally,” Tamakoshi added.

“I suggest that if you really want to know and act upon or mitigate the impacts on real people you need to call upon or at least read the words and analyses of people like myself and the Gende themselves,” she told Freeport.

Without a new exploration license for Yandera, Freeport may just be holding on to the copper mine until a bigger miner comes along to either partner with the company or buy them out directly. The company has not responded to inquiries for comment from PNG Business News at press time.

According to Emery, no site activity has been carried out since at least 2017 -- and it may take a few more years until development finally happens.