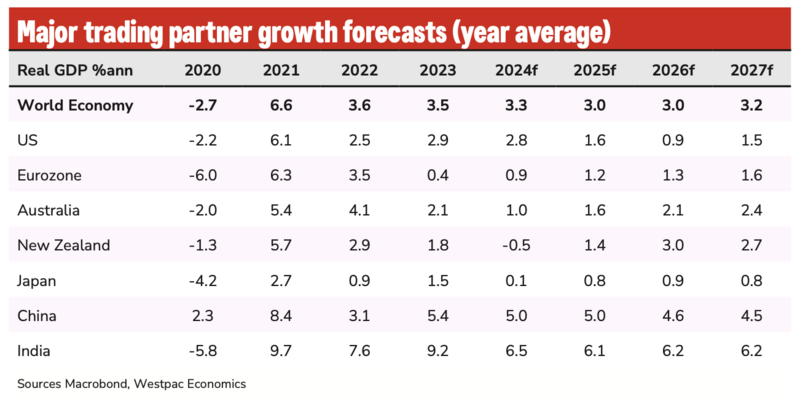

Westpac Banking Corp. has lowered Papua New Guinea’s economic growth forecast for 2025 from 5.1 percent to 4.7 percent, attributing the revision to a stronger-than-expected 2024 base. But despite the downgrade, the Australian bank remains broadly upbeat about the country’s economic trajectory, underpinned by sound fundamentals, improving liquidity and resilience in key sectors.

In its latest PNG Economic Update, released 7 July, Westpac pointed to notable developments across various sectors that have shaped its forecast adjustments. These include a strong first half of the year, significant improvements in foreign exchange (FX) market liquidity, supportive commodity prices and continued progress on fiscal reforms. Analysts say these factors have bolstered sentiment across both the private and public sectors.

“The fact PNG can grow at a pace comparable to China, without a major resources project, suggests the country has the fundamentals to build its self-sufficiency,” the report stated.

Growth backed by resources, agriculture

Westpac revised its estimate for 2024 economic growth upward to 4.3 percent, up from 3.7 percent. The change was driven by revised government data showing stronger output in petroleum and gas, particularly from the Angore project and better-than-expected performance in the mining sector. While the 2025 growth forecast has been lowered to 4.7 percent, this is mainly due to statistical base effects rather than weakening activity on the ground.

The agricultural sector continues to benefit from elevated global prices, especially for coffee, cocoa and vanilla. The first air shipment of Morobe-grown specialty coffee to Dubai in June marked a milestone for PNG’s agri-export ambitions. The shipment, organised by AFIA PNG, was hailed as a turning point in showcasing PNG’s potential to compete in premium global markets. Prime Minister James Marape described the export as a “landmark for PNG’s economy” and reaffirmed support for smallholder farmers.

Marape said this model would soon be applied to other commodities such as vanilla, cocoa and oil palm. He pledged that earnings from agricultural exports would be reinvested in infrastructure, market access and price stability. “We are building a new economy from the ground up,” he said during a recent address in Port Moresby. The government’s National Agriculture Sector Plan, focused on commercialisation and traceability, is central to this vision.

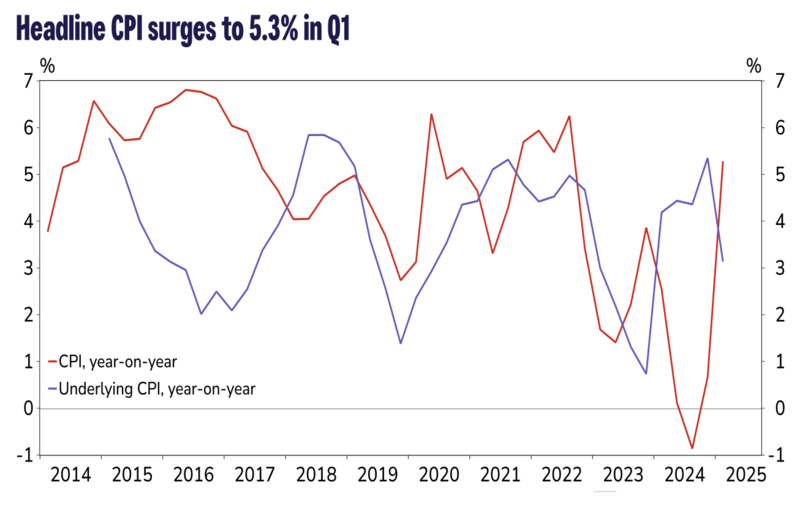

Inflation Still Uneven, Regionally Split

Price pressures remain uneven across regions. The Goroka–Hagen–Madang corridor reported headline inflation of 8.4 percent, significantly above Port Moresby’s 5.1 percent and Lae’s 1.7 percent. The sharp spike in the Highlands was attributed to localised supply issues, transport disruptions and seasonal factors. The report notes that Lae has now emerged from the deflationary trend it experienced throughout 2024.

Westpac said telecommunications and competition in digital services helped contain cost increases in urban areas. However, continued depreciation of the kina remains a key inflationary risk. As commodity-driven revenues rise, analysts stress the need for stronger monetary coordination to avoid a sustained cost-of-living crisis, especially in rural areas.

Budget Discipline Begins to Show

The government’s 2024 Final Budget Outcome (FBO) presents a cautiously optimistic picture of public finances. Total revenue increased by 5.1 percent to K20.83 billion (US$5.14 billion), while expenditure was contained at K24.76 billion (US$6.11 billion). As a result, the budget deficit narrowed to K3.93 billion (US$971 million), equivalent to 3.2 percent of GDP. This marks a notable improvement from 4.3 percent the previous year.

Much of the fiscal improvement came from higher-than-expected collections of personal income and mining taxes, buoyed by strong earnings in the resources sector. However, corporate tax receipts and GST collections underperformed due to disruptions from fuel shortages and January unrest. Donor support from Australia, ADB and the IMF also helped ease cash flow pressures during the first half of the year.

Debt sustainability has improved, with total public debt standing at K60.48 billion (US$14.93 billion), or 49.4 percent of GDP. This remains within the government’s medium-term debt strategy. Officials have prioritised concessional borrowing, shifting away from high-interest domestic debt. Reforms including payroll verification, trust fund drawdowns and the adoption of a Single Treasury Account are seen as critical to improving budget transparency and discipline.

“We are seeing steady progress in fiscal consolidation, service delivery and growth-oriented investment,” Westpac’s analysts wrote.

FX Liquidity Improves, Investor Appetite Grows

Papua New Guinea’s FX market has shown dramatic improvement in recent months. Orders for essential imports, once subject to weeks of delays, are now being processed and filled within the same day under current guidelines. This turnaround has injected momentum into the retail and wholesale trade sectors and reduced pressure on businesses dependent on imported goods.

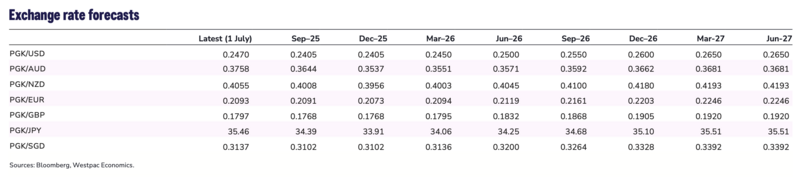

The Bank of Papua New Guinea conducted four FX auctions in May, injecting K165.3 million (US$40.8 million) into the system. This helped stabilise supply and meet trade-related demand. The kina–US dollar exchange rate eased from 0.2452 to 0.2438 in May, and Westpac expects it to weaken further to 0.2402 in the third quarter. A meaningful recovery in the currency is not anticipated until 2026.

Domestic capital markets also showed signs of investor confidence. In a May auction, the 9-year government bond attracted K40 million (US$9.88 million) in bids—double its K20 million (US$4.94 million) offer—at a weighted average yield of 9.46 percent. The longer tenor indicates growing appetite for stable, long-term returns as PNG’s macroeconomic picture improves.

Major Investments Signal Confidence

Kumul Consolidated Holdings is doubling down on local industrial capacity. It committed K200,000 (US$49,400) to sponsor the second Papua New Guinea Special Economic Zone (SEZ) Summit and confirmed a K160 million (US$39.5 million) tuna cannery will open this month. The facility is expected to create hundreds of jobs and support the government’s ambition to process all fish domestically.

Meanwhile, K92 Mining continues to expand its footprint, reporting a 134 percent increase in financial contributions to PNG. The company paid US$62.6 million in taxes and royalties, supported nearly 1,800 jobs and spent over US$96 million on local procurement. It also recorded more than 643 days without a lost-time injury, reflecting its focus on worker safety and community engagement.

Prime Minister Marape has also announced the partial privatisation of PNG Power Ltd, signalling a shift in strategy to attract private capital into underperforming state-owned enterprises. Marape said PNG’s energy potential—especially in hydro, solar and geothermal—could power exports to regional markets like Indonesia and northern Australia. “We are unlocking our energy for growth and trade,” he said.

Outlook: Stable, But Watch the Risks

Despite growing optimism, analysts warn that global headwinds remain. Westpac flagged persistent uncertainty surrounding US tariff policy and recent geopolitical flare-ups, including conflict between Iran and Israel, which briefly pushed up oil prices. Although markets have stabilised, any deterioration in global trade conditions could spill over into PNG through energy and import costs.

That said, domestic fundamentals remain strong. Imports are now growing at an annualised pace of 4 percent, indicating rising confidence and improved capacity to meet consumer demand. FX constraints that once stifled trade and investment are easing, creating new opportunities for business expansion and job creation.

Without the boost of a new large-scale resource project, PNG’s growth this year will come largely from internal drivers—household consumption, agriculture and services. That, according to Westpac, is a promising sign of resilience. “With improving fundamentals, PNG continues to grow,” the report said.