In Part I, we read about the signs of oil and gas throughout Papua New Guinea that enticed many oilmen to look for large oil and gas fields over many decades, and we read about the first commercial oil discovery at the Iagifu 2-X well and how the Kutubu field was successfully developed. We now pick up the story where subsequent exploration wells found mainly gas fields rather than oil fields.

When Papua New Guinea realised that its petroleum endowment was not so full of oil, but was comprised substantially of natural gas resources, it was recognised that gas would be difficult to develop in the absence of any domestic gas demand from households, commerce, or industry, and all the more so being remote from the gas markets of other nations.

So, in 1992, the Government through the newly-established Petroleum Branch, commissioned a study on all the discovered oil and gas fields of Papua New Guinea. This work was conducted by the US firm, Scientific Software Intercom in collaboration with the officers of the Petroleum Branch and sought to assess the extent of the petroleum resources and reserves to proper and systematic standards of reserve reporting then published by the Society of Petroleum Engineers.

Based on summations of the reserves, an economic study was undertaken applying the then prevailing Papua New Guinea petroleum fiscal regime. The results were presented to the National Executive Council (the Cabinet) showing that if the production from the gas fields discovered to date were aggregated, there could conceivably be a commercially viable gas development based on the export of Liquefied Natural Gas (LNG) to East Asian markets, but more work would be needed to obtain better quantification of the gas field development costs and the construction costs of a LNG plant and export facilities.

The Government liked the idea of gas development and embarked on examining its policies for such and began fostering the notion of gas development. Economic and policy studies were conducted and extensive discussions between gas field owners and promoters ensued.

In 1995, the Government tabled a White Paper on Natural Gas Policy before the Papua New Guinea Parliament. The policy laid down the regulatory and fiscal terms that the Government was willing to consider for the encouragement of investment in gas development. Key features were the introduction of Petroleum Retention Licences (PRLs) to allow the companies to keep their discoveries beyond the period of tenure provided by a normal Petroleum Prospecting Licence. This would be allowed in consideration of an acceptable programme of gas field appraisal and delineation, conduct of commercial studies and development promotion by the licensees. So long as a field was currently not commercially viable, the PRLs would allow retention for up to 15 years.

The gas policy also introduced a single ring-fence for the field development, gas pipeline infrastructure, LNG Plant and marine facilities. And based on considerable economic modelling, the Government landed on a concept of 50/50 sharing of the net value between the developer and the Government. The income tax rate for gas operations was set to 30% of net profits and the State decided it would keep its right to take up to 22.5% equity in the entirety of any development, including the LNG plant and associated facilities. Royalty rates were left at 2% of the wellhead value.

With the foundations for the gas development defined by the revised gas regulatory and fiscal regime, Exxon and BP pursued their LNG development plans based on the large Hides gas field with notions of taking the gas to the Papua New Guinea north-coast and a deep water plant site at Madang. However, these plans faltered due to the Asian financial crisis in 1997 and the consequent sudden reduction in East Asian LNG demand and the terrible tsunami that occurred in 1998 at Aitape on the north coast. An account of the tsunami was made by Prof. Hugh Davies of the University of Papua New Guinea in his book Aitape Story published in 2007. He attributed the devastating waves to movement on a sea floor fissure arising from a 7.0 magnitude earthquake. That movement caused a slump of seabed bottom sediment which would have generated the wave.

The tsunami demonstrated that whilst placing any LNG facilities nearer to markets, any north coast-located LNG facility would have to be built to much more exacting standards to cater for the additional seismic risk, as compared to the south coast. The Petroleum Division, mindful of the seismic hazards of the New Guinea part of Papua New Guinea, had earlier commissioned a Papua New Guinea Seismic Hazard Study, prepared by Dr Horst Letz, a renowned seismologist, which was completed around the time of the tsunami. It clearly defined the risk and indicated that a southern coast location for a LNG plant and facilities would be preferable.

When the amendments to the Petroleum Act were being prepared for gas development pursuant to the 1995 Gas Policy, the results of policy studies on landowner benefits (both royalty and equity sharing), strategic access to pipelines and processing facilities and elementary domestic gas business provisions became available, and an effort was made to incorporate these matters into the amendments.

The Government was intent in providing statutorily defined benefits to communities hosting any future oil and gas development together with a proper process of consultation and liaison with communities. For such benefits, the Government devised the idea of a separate Development Agreement between the community parties and the State, which would be agreed in a formally convened Development Forum after proper research had been made as to land matters through the conduct of social mapping and landowner identification studies carried out by the licensees.

Significant and specific political lobbying arose from the Southern Highlands Province (home to the major oil and gas fields) for the Government to consider making a separate Gas Act for gas operations. In the resulting compromise, the Government agreed at the political level to introduce some of the reforms suggested by the Province, but only if the Act would remain intact, though it was now agreed that the new Act would be rebranded as the Oil and Gas Act, whilst still referring to petroleum for the most part.

Thus, the Oil and Gas Act, No 49 of 1998 was born. It represented a major restatement of the former Petroleum Act, covered much new ground and paved the way for improved participation by communities and their sharing in benefits.

Later, BP withdrew from Papua New Guinea and took their ideas about Papua New Guinea LNG development to West Papua in Indonesia where they successfully launched the Tangguh LNG Project. Then, Chevron, realising that they were handling increasing volumes of associated gas in their operation of the Kutubu oil fields, re-injecting as much as 400 million standard cubic feet of gas per day bought out the commercial notions that the International Petroleum Corporation (the early Lundin company) had about developing their offshore Pandora gas field in the Gulf of Papua, and sending that gas to Townsville in Queensland, Australia to supply a 200-megawatt power plant.

A period followed when all development notions were focused on transmitting gas to Australia from the producing oil fields, plus the undeveloped gas fields. With Kutubu oil production declining, Chevron departed the venture, selling its Papua New Guinea interests to Oil Search and over the course of several years, the schemes waxed and waned.

The Papua New Guinea Gas Project, alias Papua New Guinea Gas to Queensland Project or Gas to Australia Project ended up with over 4,300 kilometres of trunk gas pipelines and lateral pipelines hanging off the Papua New Guinea gas sources. Most of that infrastructure was in the north-eastern quadrant of Australia and was to be expensed against the supply of gas to a wide and quixotic range of Australian gas customers.

With low gas prices, high steel prices and the emergence of coal seam methane development notions in Australia, finally it was realised that Papua New Guinea might end up giving its gas away for nothing and that the only value For Papua New Guinea might remain in the natural gas condensates extracted in Papua New Guinea. The Papua New Guinea Gas Project for the supply of gas to Australia thus failed.

An abrupt turn was made to change all the development ideas toward supplying a LNG plant to be located on the Papuan South coast and an effort made to market the gas as LNG to East Asian markets. The dependence on external infrastructure and specific gas demands in Australia was also not seen as either politically attractive or sustainable. Thus, was born the Papua New Guinea LNG Project, more familiarly known as the PNG LNG Project.

PNG LNG has many factors in its favour as a distinct source for LNG for supply to East Asian markets. Papua New Guinea is a non-aligned Christian nation; it is not an Islamic nation. Papua New Guinea is desirous of investment and keen for development based on commercial oriented fiscal terms. Papua New Guinea as a nation has open-ocean access from its shores to customers and does not rely on any strategic straits. It has a Westminster-style Government and observes the principles of law and contract.

Papua New Guinea is favourably positioned to supply the Australasian region, but can reach out to serve Asian, Pacific and American markets. With diminishing oil production and the absence of new oil finds, Papua New Guinea’s explorers needed to capitalise on prior exploration investments that failed to find oil. Gas in the new century was no longer a hindrance and could be profitably developed even extending the life of the oil fields.

The PNG LNG project was projected to export LNG at a heating value of 1,135 BTU/SCF gas and the liquids were forecast to sell at US$ 60/barrel. Anticipated LNG prices were: US$ 8.07 per MSCF: equivalent to US$ 10.20 per MMBTU, or US$ 9.69/GJ.

The original plant design was upgraded early on from.6.3 million tonnes per annum to 6.9 million tonnes per annum for production over a 30-year period. Gross income was estimated to be ~ US$ 74.3 billion. Even at US$ 50/barrel oil, the project was still forecast to yield US$ 61.9 billion in LNG sales. The gas is rich in natural gas liquids, so at just 20 BO/MMSCF, some 210 million barrels of natural gas liquids were forecast to yield an additional US$ 12 billion of sales revenue.

And so, in May 2014, Papua New Guinea became an LNG exporter, and is now producing about 8+ mta LNG per annum to customers in China, Japan and Taiwan - well above the original nameplate capacity of the LNG Plant. It got there because of fine operatorship on the part of ExxonMobil of a coherent joint venture. ExxonMobil was able to market the gas to top quality customers and obtain superior project financing.

The only major disappointment has been the collapse several times in the crude oil prices below projections, and hence the LNG prices due to the indexing with crude oil. For the first year, some elevated prices were obtained, but clearly the fall of crude oil below US$ 30 per barrel in 2015 hurt the project economics, as did the see-sawing of prices in the aftermath of the Covid pandemic when prices plummeted to less than US$ 3 per MMBTU only to soar to over US$ 60 per MMBTU later. The markets have calmed down now.

Access to lands for the project development came with resounding landowner consent after an enormous development forums were held at project level in Kokopo in New Britain and at licence level in each licence area. During the forums, the sharing of the benefit streams of the 2% royalty, 2% free equity from the State, 2% development levy, and other project grants including business development grants and infrastructure grants were discussed.

Oddly, whilst some grants have been paid, some of the royalties and equity benefits have yet to be distributed due to some remaining uncertainties about landownership, and/or challenges based on rivalry. But notwithstanding this situation, the landowners have been extremely patient and have remained stoical. Indeed, the landowners have negotiated with the Government for the vendor financing of additional equity in the PNG LNG Project of about 4.2% that was promised to them in the main development forum in Kokopo. These equity holdings will be most valuable once the project finance has been paid down. The fact that the landowners see that value, needs to be recognised.

What is next? There are plans for additional LNG trains being added to the existing location for further LNG output.

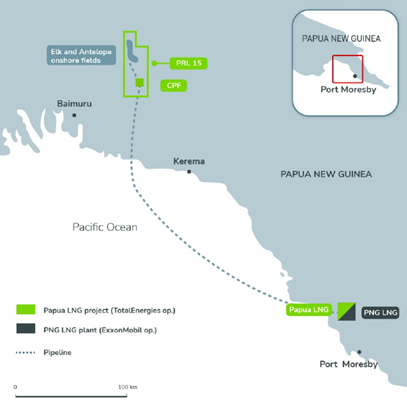

In 2008, a significant gas discovery was made at the Elk-4 well of InterOil Ltd drilled in the Gulf Province. This was appraised by further drilling and the reservoir intersected in this well shown to be part of a much larger and better-quality reservoir by the drilling of the nearby Antelope 1 well. Gas reserves of this field are estimated to be about 6.2 TCF (equivalent to about 1.2 billion barrels of oil). InterOil was a small entrepreneurial company with little experience, and whilst they tried to consider developing what became known as the Elk-Antelope gas field, they eventually sold down their assets to major international companies – Total of France and ExxonMobil of the USA, and to Papua New Guinea’s local oil and gas company – Oil Search, which merged with Santos in December 2021 in a $22 billion deal.

Total, now rebranded as TotalEnergies, is the operator of the Papua LNG Project which seeks to develop this gas field separately, but in synergy with the PNG LNG Project. After considerable delays, finalising a Gas Agreement with the State, they agreed upon outstanding issues and are now very much resolved to proceed with the project. TotalEnergies, as operator, submitted their application for the licences required for the Papua LNG Project on 28th May 2023.

The Papua LNG Project will develop the Elk-Antelope gas field and transmit the gas by a new pipeline to the Caution Bay site occupied by ExxonMobil. There Total will have four new electric driven LNG processing trains built, each of 1 million tonnes per year capacity next to the current trains of the PNG LNG Project. It is planned to place the remaining gas through ullage within the existing LNG plant of the PNG LNG Project, owned and operated by ExxonMobil and its partners. The condensate would be exported through the Caution Bay site at a separate loading facility, whilst some existing facilities of ExxonMobil will be utilised such as the site utilities, camps and the jetty, and some will be upgraded for consequent greater use. The Papua LNG Project aims to produce about 6 million tonnes LNG per annum (mta).

The FEED (Front End Engineering and Design) work for the upstream field facilities started in July 2022 and was awarded to French firm Technip Energies NV. The FEED work for the downstream LNG plant started in March 2023 and was award together with the Engineering, Procurement and Construction (EPC) contract to JGC Corporation in partnership with Hyundai Engineering & Construction Co., Ltd.

TotalEnergies has publicly confirmed that the project remains on track for a Final Investment Decision (FID) in 2024 with the first LNG production anticipated in late 2028/early 2029. The project is estimated to cost about US$12 billion and it is expected to expand Papua New Guinea’s GDP by 50%, or so. At present, there has been no announcement of project financing or LNG sales and purchase agreements that might underpin the project, though TotalEnergies remains confident, and perhaps a little, but appropriately, tight-lipped on such matters!

The shareholders in the project are TotalEnergies (operator) with a 40.1% stake; ExxonMobil (following the acquisition of InterOil in Feb. 2017) holding 37.1%; Santos Ltd. (following the acquisition of Oil Search Ltd in Dec. 2021) with 22.8%; while the Papua New Guinea government retains the option to exercise a back-in right for up to a 22.5% interest at the time of the grant of the project licences.

In an innovation of a kind, the development of the P’nyang LNG Project for which the Government has negotiated, agreed and signed a Gas Agreement with the companies is now planned to take place after the construction of the Papua LNG Project starting in 2028, and again lasting for about four years.

This project will not involve the building of any new liquefaction facilities, but will rather transmit its produced gas to the nearest trunk gas pipeline of the PNG LNG Project. The gas will then be transported by the PNG LNG Project for a commercially agreed tariff and delivered to the PNG LNG Project LNG plant where it will be tolled through the facilities and exported.

The P’nyang gas will therefore be what is known as “back-fill” gas for the PNG LNG Project LNG plant when it has already depleted and processed the gas from its project dedicated gas fields. P’nyang gas will therefore optimise gas throughput of the PNG LNG Project pipeline and facilities extending their life and making further income both for the companies and the Government. This obviates the need for new facilities and represents a significant capital saving.

The P’nyang LNG Project is estimated to cost about US$ 9 billion and seeks to develop about 4.4 TCF of gas reserves (about 860 million barrels of oil equivalent) and should extend the useful life of the PNG LNG Project facilities by about 10 years to around 2046.

Gas development beyond what is described above depends on linking other discovered gas fields that are smaller and more remote to the infrastructure and the development of yet-to-be- discovered gas fields. Exploration density in Papua New Guinea is very low due to limited infrastructure and access to petroliferous areas, so one can reasonably anticipate that if exploration drilling is encouraged significantly more gas reserves might be identified.

With the combined processing capacity of the ExxonMobil-led PNG LNG Project (8.3 million tonnes per year) and the TotalEnergies-led Papua LNG Project (4 million tonnes per year), there will be an aggregate capacity to process 13.7 million tonnes of LNG per year (equivalent to about 300,000 barrels of oil per day).

Some have dared to talk that a LNG output of 20 million tonnes per annum is possible for Papua New Guinea in the foreseeable future. However, a few hurdles remain, primary amongst which is a lack of new wildcat drilling to find new gas fields, perhaps due to uncertain and undefined petroleum sector policy.

Papua New Guinea can still be successful in producing oil and gas well into the future, but it has to learn that it takes more than oil and gas reserves to create a viable and sustainable production industry. A review of its past successes should indicate what it needs to do. It has the natural gas resources in volumes enough to keep the current and planned trains filled, and perhaps more trains, but it must continue to be proactive in all aspects of gas development planning, promotion and participation. Importantly, the promised benefits to landowner in particular and to the wider public need to be delivered by the Government.

Any lapse into baseless self-indulgent or impractical schemes could readily spoil what is essential a very good framework for continued gas development investment, notwithstanding the plans to change the regime structure to one of production sharing. The future of PNG’s gas industry is firmly in the hands of the Government with excellent operators to assist it.